|

|

|

|

| Thursday, November 8, 2018 |

|

|

|

|

| |

| Today's Featured Topic |

| Semiconductors Experience a Wave of Secular Growth |

|

|

| The semiconductor industry is experiencing a wave of growth thanks to fresh investments, hundreds of new market entrants, and falling development costs. |

|

|

| Although you would not know it from the year-to-date performance of the iShares PHLX Semiconductor ETF (SOXX), which has lagged the broad market S&P 500 index, semiconductors are currently enjoying booming conditions. Semiconductors are the cornerstone technology of the information age. These tiny electronic devices, usually smaller than a postage stamp, power the modern economy by acting as data-processing brains for products, from smartphones to cars and spacecraft.

Not too long ago, the design and manufacture of chips had become so expensive that very few new businesses were able to enter the market. Now, the chip market is experiencing a wave of growth thanks to fresh investments, hundreds of new market entrants, and falling development costs. With that, the industry that was struggling just a few years ago, grew by 22% last year.

Several factors are driving this growth.

Secular tailwinds Semiconductors have been indispensable in computers, mobile phones, games, cars, military weapons, and even home appliances for quite some time. As a highly cyclical business, demand typically tracks end-market demand for those products. A slowdown in PC sales, for instance, can send chip makers into a bust cycle. But at times, as is currently the case, secular forces play a larger role. In this era of cloud computing, Internet of Things (IoT) and Artificial intelligence, larger volumes of data have to be collected, stored, and processed, and at a faster rate than ever before. The advent of 5G, autonomous vehicles and drones will only accelerate the volumes of data.

All these trends are creating secular growing demand for memory chips, microprocessors, commodity integrated circuits, and complex System on a Chip (SOC). Memory chips serve as temporary storehouses of data and pass information to and from computer devices' brains. Microprocessors are central processing units that contain the basic logic to perform tasks. Commodity Integrated Circuits (aka "standard chips”) are for routine processing purposes, and SOCs are all about the creation of an integrated circuit chip with an entire system's capability on it. Each of these segments is growing, with SOCs growing the fastest.

Falling Development Costs Smaller, faster and cheaper has always been the credo for chip makers. If more transistors can be packed onto the same small chip, it can perform faster. Consequently, there is constant pressure on chip makers to come up with something better than what redefined state-of-the-art only a few months before. New tools are furthering the design of chips at reduced costs and development times. The use of high level synthesis techniques, for example, has made it possible to deliver a product in a quarter of the time that it would take with traditional methods. And, with new technologies lowering the cost of production per chip, within a matter of months, the price of a new chip can fall by 50%.

Investment Boom As a rule, the greater the percentage spent on R&D, the more opportunities are available for developing new chip products. Lately, investments have been pouring back into the industry, particularly for companies developing new application-specific processors that deliver a distinctive type of functionality. Venture capital spending in fabless semiconductor production has skyrocketed over the past year and could touch $2billion in 2018. Just a few years ago that figure was running at just $300 million.

China, in particular, is ramping up its expenditures in semiconductor R&D and manufacturing as part of the nation’s ambitious “Made in China 2025” blueprint. The country now consumes more than half of the world’s chips, and the government is investing $20 billion annually, an amount that is being matched by private investors. In fact, China’s investment in the industry has been six times that of the US in the past few years and that trend will likely accelerate. Chinese officials have set their semiconductor industry a goal of reaching US$305 billion in output by 2030, and meeting 80% of domestic demand. That’s a leap from 2016 when China produced US$65 billion worth of semiconductors and supplied 33% of its domestic market.

More Companies Designing Chips The industry used to be dominated by just a few giants, but nowadays, more companies are designing their own chips. Never has the sector been more competitive, with more than 750 companies vying globally to build the insides of the next hot device or to power future quantum computers. Bosch is building its own fab. Chinese smartphone giant Huawei recently unveiled its new artificial intelligence (AI) chips, putting itself in direct competition with the main AI chip developers in the U.S., namely Nvidia, Intel, and Qualcomm, but also ARM, IBM, and to some degree Google. Even Tesla is building its own chips.

In September, Alibaba announced the establishment of a dedicated chip subsidiary aimed at creating customized AI chips and embedded processors to further support the tech giant's cloud and IoT businesses, as well as drive the development of industry-specific applications. The company plans to launch its first AI chip AliNPU, which could potentially support technologies used in autonomous driving, smart cities and smart logistics in the second half of next year.

Surging Worldwide Sales Three-quarters of the way through 2018, the global semiconductor industry is already on pace to post its highest-ever annual sales, with China and the Americas leading the way. According to the Semiconductor Industry Association (SIA), year-to-date sales of about $348 billion puts the global chip market 16.7% ahead of the first nine months of 2017 and on course to achieve sales between $450 billion and $480 billion. Compared to September 2017, sales increased the most in China (26.3%), the Americas (15.1%), Europe (8.8%), and Japan (7.2%).

These higher sales should eventually reflect in the reported earnings and stock price of semiconductor companies. Investors can gain exposure to the industry via the iShares PHLX Semiconductor ETF (SOXX). The fund focuses on U.S. stocks, but it also puts one-quarter of its assets in international firms. |

|

|

| We've also summarized the following articles related to this topic in the Technology section of today's report.

Semiconductors |

- Skynet, The First Blockchain on Chip — Road to Blockchain IoT Device Interconnectivity

- New semiconductor paves the way to super powerful, greener phones

- Chinese companies rush to make own chips as trade war bites

- U.S. court rules Qualcomm must license technology to rivals

- Merrill Lynch Says Now’s Your Chance to Buy 4 Semiconductor Giants

|

|

|

|

|

| |

| Disruptive Change Updates

|

|

|

| Markets |

| Treasuries The Treasury Market Has a Big Chicken-and-Egg Problem |

|

|

| Finance |

| THEME ALERT Banks Big banks are in for rough ride in new Washington |

| Payments Americans Just Got Used to Dipping Credit Cards. Now It’s Time to Tap |

|

|

| Services |

| Cannabis Midterms Lift Marijuana Stocks; 'Fundamental Shift' Benefits These Companies |

| Esports China esports victory points to lofty ambitions in nascent sector |

|

|

| Commodities |

| THEME ALERT Cobalt Cobalt mine sales halt to push up price of key electric car metal |

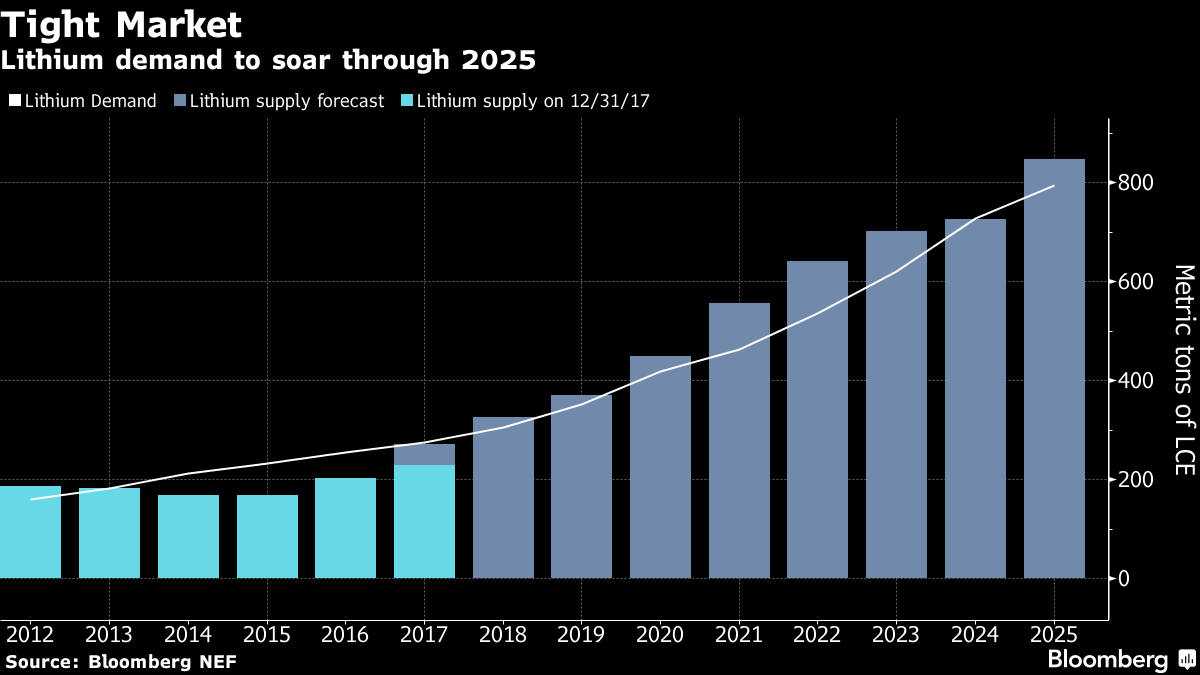

| THEME ALERT Lithium Lithium Market `Problematic' on Project Delays, Livent CEO Says |

|

|

| Endnote |

| THEME ALERT US Housing Home prices rise in September, but slowdown is on the horizon |

|

|

|

| Economics & Trade |

| THEME ALERT ASEAN US-China trade war set to make big winners out of Asean countries |

| THEME ALERT ASEAN World Craving for Vietnam's Robusta Coffee Has Exports Surging |

| Brexit A $240-Billion-a-Day Market Is Leaving London Over Brexit |

| India India central bank governor could resign on November 19: report |

|

|

| Energy & Environment |

| Batteries BNEF raises forecast for global battery deployment to $1.2T by 2040 |

| Fuel Cells Soda Can Metal May Solve Hydrogen Fuel Cell Problem |

| Fusion MIT Plans New Fusion Reactor That Could Actually Generate Power |

| Renewables Non-Hydro Renewables To Replace Nuclear In Germany, Reaching 71.9% By 2030 |

| Renewables Scottish utility goes 100% renewable, pushes electric vehicles too |

| Renewables Global Floating Solar Capacity Surpasses 1 Gigawatt |

| Utilities Siemens Says AI Can Boost Power Plant Profit by 20% |

|

|

|

|

| |

| Joe Mac's Market Viewpoint |

|

|

|

|

| FX Matters The dollar's ups and downs have had significant repercussions. The earnings of global companies, the trend of interest rates, commodity prices, and many nations’ economies – emerging markets in particular – have all been impacted. This issue of MRP’s Viewpoint first examines the forces driving the dollar’s fluctuations, then looks at where the buck might go next and offers some thoughts on what it could mean for the capital markets.

Joe Mac's Market Viewpoint: FX Matters → |

|

|

|

|

|

|

|

|

|

|

| LONG ASEAN Markets |

|

|

| LONG Defense |

|

|

| LONG Industrials |

|

|

| LONG Materials |

|

|

| LONG Palladium |

|

|

| LONG Steel |

|

|

| SHORT U.S. Housing |

|

|

| LONG Video Gaming |

|

|

| SHORT Autos |

|

|

| LONG Electric Utilities |

|

|

| LONG Lithium |

|

|

| LONG Obesity |

|

|

| LONG Robotics & Automation |

|

|

| LONG TIPS |

|

|

| SHORT U.S. Pharmaceuticals |

|

|

|

| LONG CRISPR |

|

|

| LONG Gold & Gold Miners |

|

|

| SHORT Long-Dated UST |

|

|

| LONG Oil & U.S. Energy |

|

|

| LONG Solar |

|

|

| LONG U.S. Financials & Regional Banks |

|

|

| LONG Value Over Growth |

|

|

|

|

|

|

|

|

|

|

| US Stocks Surge on Midterm Election Outcome

Wall Street closed deeply in the green on Wednesday 7 November 2018 after US midterm elections resulted in a divided Congress as widely expected, with Republicans consolidating their hold on the Senate and Democrats taking the House of Representatives. The Dow Jones soared 545 points or 2.1% to 26180. The S&P 500 jumped 58 points or 2.1% to 2814. The Nasdaq surged 195 points or 2.6% to 7571. It was the best midterm election rally since 1982. TE |

|

|

| Dollar Falls after Midterm Elections

The dollar index declined on Wednesday as outcome of the US midterm elections, with Democrats gaining control of the House and Republicans increasing Senate majority, lowered expectations of further economic stimulus such as tax cuts. The DXY was down 0.5% to 95.83 around 9:15 AM London time, the lowest in near 3 weeks. TE |

|

|

| US 10-Year Yield Falls after Midterm Elections

The yield on the US 10-year Treasury note fell to 3.178% on Wednesday from a high of 3.25% overnight after the US midterm elections resulted in a split Congress with Democrats winning the House and Republicans keeping the Senate, making it more difficult to pass further economic measures such as tax cuts and infrastructure spending plans. TE |

|

|

| US Consumer Credit Climbs Below Expectations

Consumer credit in the United States went up by USD 10.92 billion in September 2018, following an upwardly revised USD 22.88 billion gain in the previous month and below market expectations of a USD 16.5 billion rise. Revolving credit including credit card borrowing edged down USD 0.3 billion, compared to USD 4.6 billion decline in August. Meantime, non-revolving credit including loans for education and automobiles climbed by USD 11.20 billion, after rising USD 18.3 billion in the prior month. TE |

|

|

| US Mortgage Applications Fall for 2nd Week: MBA

Mortgage applications in the United States went down 4 percent in the week ended November 2nd 2018, after a 2.5 percent drop in the previous week, data from the Mortgage Bankers Association showed. Refinance applications decreased 2.5 percent and applications to purchase a home slumped 5 percent. The average fixed 30-year mortgage rate rose by 4bps to 5.15 percent, the highest rate since April of 2010. TE |

|

|

| US Crude Oil Inventories Rise More than Expected

Stocks of crude oil in the United States rose by 5.783 million barrels in the week ended November 2nd 2018, following a 3.217 million increase in the previous week and above market expectations of a 2.433 million gain. Meanwhile, gasoline inventories went up by 1.852 million barrels compared to market forecasts of a 2.276 million decline. TE |

|

|

| European Stocks End Higher on Relief Over US Midterms

European stocks finished higher on Wednesday after US midterm elections resulted in a divided Congress as widely expected, with Republicans consolidating their hold on the Senate and Democrats taking the House of Representatives. TE |

|

|

|

|

| Disruptive Change Updates |

|

|

|

|

| |

| Markets |

| Treasuries The Treasury Market Has a Big Chicken-and-Egg Problem

The world’s biggest bond market faces a conundrum. Figuring out the answer could guide traders for the rest of the year and into 2019. The market for principal- and interest-only U.S. Treasury securities, known as Strips, rose by a record $12.2 billion in October, according to data released Tuesday. These zero-coupon bonds are favorites of defined-benefit pension funds and other asset-liability managers because their long duration characteristics align with their obligations. Indeed, almost all the stripping was done on debt due in roughly 30 years.

Here’s the thing: Thirty-year Treasury yields rose about 19 basis points last month, eventually touching a four-year high on Nov. 2. Such unprecedented demand for Strips would normally indicate support at the long end of the market. It raises the specter of an even more severe sell-off — and a drastically steeper yield curve — if that activity slows down.

But it could also be that the higher bond yields drove that demand. After all, the most extreme move came early in the month, on Oct. 3, when the 30-year yield rose by 12 basis points. Given that the long bond fluctuated in the ensuing three weeks, it’s conceivable that the Strips buyers emerged and kept yields relatively in check. But just from looking at the numbers, it’s hard to know for sure.

Interpreting this chain of events will be crucial for bond traders in the months ahead. B |

|

|

|

|

| |

| Economics & Trade |

| ASEAN US-China trade war set to make big winners out of Asean countries

Attendees at the Bloomberg New Economy Forum in Singapore heard that the relocation of production out of China to lower-cost countries in the Association of Southeast Asian Nations had been taking place for a number years. But the US-China trade war had prompted a sharp acceleration of that trend to avoid US import tariffs on Chinese goods. Patrick Burke, chief executive officer of HSBC US, said a manufacturing client had already been thinking about moving his company’s factories to Cambodia and Vietnam, but was now pushing ahead with that process at a faster pace.

Some 86 per cent of corporations doing business in Asean countries are optimistic about their foreign trade prospects, above the global average of 77 per cent and higher than any other global trading bloc, according to the findings of an HSBC Navigator survey released earlier this week.

But at the same time, 75 per cent of Asean firms admitted that governments are becoming more protectionist in their key export markets, a score that is also the highest among all trade blocs in the world, exceeding the global average of 63 per cent, according to the same survey conducted this autumn.

This seems counter-intuitive at first glance and it certainly raises the question of whether they are underestimating the trade risks that come with rising protectionism, or are shrewdly seeing opportunity among the trade disruption. SCMP |

| ASEAN World Craving for Vietnam's Robusta Coffee Has Exports Surging

Coffee shipments from Vietnam will set a new record this year, supported by global demand for its key robusta variety. Exports of all varieties are likely to top 1.8 million metric tons, according to Do Ha Nam, the chief executive officer of Intimex Group, the largest shipper in the country. Nam is also vice head of the Vietnam Coffee and Cocoa Association, the main industry grouping in the world’s largest robusta grower.

Global consumption of robusta, mainly used by companies including Nestle SA to make instant coffee, is forecast to climb to a record this season, supported by growing demand for the instant variety in developing markets. That’s good news for farmers in Vietnam, who enjoyed a 10 percent jump in local prices in October as global benchmark futures rebounded.

To feed that demand, Intimex this year added three robusta processing plants with a combined capacity of 180,000 tons, bringing its total capacity to 750,000 tons, Nam said last week. The company expects its overseas sales to grow 20 percent to an all-time high of 510,000 tons this year. As well as being an exporter, Vietnam imports beans for re-export and for domestic use. B |

| Brexit A $240-Billion-a-Day Market Is Leaving London Over Brexit

CME Group Inc. is moving its European market for short-term financing, the largest in the region, out of London because the exchange operator wants to guarantee continental firms can continue to use it if there is a no-deal Brexit.

The decision, which was taken before CME took over the business from NEX Group Plc last week, is the first example of a major financial market leaving the U.K. While every sizable trading venue has set up a regulated entity in the EU because of Brexit, BrokerTec -- as the business is known -- is the first to move an existing market from London to a continental European city: Amsterdam.

BrokerTec isn’t alone in planning for the worst. Stifel Financial Corp. is ensuring it can continue offering financial services in Europe by buying the brokerage operations of Germany’s MainFirst Holding AG. And BNP Paribas SA plans to move between 85 and 90 employees from its global markets unit in London to other European financial centers in case of a hard Brexit.

About 210 billion euros ($240 billion) per day of European short-term financing instruments were traded on BrokerTec in October. B |

| India India central bank governor could resign on November 19: report

The Indian government intends to keep pressing demands for the country’s central bank to relax lending curbs and hand over surplus reserves even if it risks provoking a resignation by the bank’s governor, three sources familiar with the government’s thinking told Reuters.

While there appeared to be a partial truce last week when the government said it respected the autonomy of the Reserve Bank of India (RBI), the sources said the government will turn up the heat at the bank’s central board of directors meeting on Nov. 19. And RBI Governor Urjit Patel will be a key focus of the pressure from a group of directors who support the government’s position, according to the New Delhi-based sources, who declined to be named due to the sensitivity of the matter.

“We want the RBI governor to accept the priorities of the economy and to discuss these with board members,” said one of the sources, a senior government official with direct knowledge of deliberations. “If he wants to take decisions unilaterally, it will be better for him to quit.”

Investors and traders warn that if Patel quits it will create uncertainty and undermine India’s already-weak financial markets. They have been hurt in recent weeks because of defaults by a major financing company. R |

|

|

|

|

| |

| Finance |

| Banks Big banks are in for rough ride in new Washington

The House Democratic takeover likely means Rep. Maxine Waters (D-Calif.) will seize the gavel of the House Financial Services Committee. And industry insiders expect her to subject certain firms to painful scrutiny while also throwing a wrench into the Trump administration’s deregulatory push. Waters has introduced legislation (“The Megabank Accountability and Consequences Act”) requiring bank regulators to dismantle any big firm found to have repeatedly harmed consumers.

Wells Fargo, with its litany of consumer abuse scandals, tops the list of megabanks in line for rough treatment under the committee’s hot lights. Equifax, the consumer credit company that exposed the data of up to 148 million people in a data breach last year, and Deutsche Bank, which supplied hundreds of millions of dollars in loans to the Trump Organization when other banks turned it down.

A key question for these firms is whether the attention will amount to more than a public drubbing. “A lot of this is headline risk, but they have to prepare to handle that and make sure it doesn’t spiral into real regulatory or legal concerns,” says Jason Rosenstock, a partner at the lobbying firm Thorn Run Partners. WaPo

|

| Payments Americans Just Got Used to Dipping Credit Cards. Now It’s Time to Tap

Starting about three years ago, Americans were asked to insert—or dip—their credit cards at the checkout instead of swiping them. Now, thanks largely to the New York subway, they’ll soon be tapping.

Starting next year, New York’s Metropolitan Transit Authority will join other transit systems around the U.S. in saying goodbye to paper Metrocards as it introduces a new payment system that allows riders to tap their credit or debit card at turnstiles. To prepare, the country’s largest banks have begun to issue so-called contactless cards that will work with these new systems.

“The credit card and banking industries are working in parallel with us,” says Patrick Foye, president of the Metropolitan Transit Authority. “This is where transactions—not only in transit but outside transit—are increasingly going to be in the United States.”

Visa Inc. predicts 100 million of its cards in the U.S. will be converted to contactless by the end of 2019. Some issuers, such as American Express Co. and Capital One Financial Corp., have already begun the transition. Capital One’s Quicksilver, Savor and Venture card portfolios are already enabled for tap-to-pay as is AmEx’s recently retooled gold card. B |

|

|

|

|

| |

| Services |

| Cannabis Midterms Lift Marijuana Stocks; 'Fundamental Shift' Benefits These Companies

Marijuana stocks rose a day after Tuesday's midterm elections, in which three states voted to legalize cannabis and the Democrats regained House control, presenting room for advancement for U.S. cannabis companies like Curaleaf, MedMen and Green Thumb Industries.

Voters in Michigan on Tuesday approved recreational marijuana legalization in their state. The vote, when certified, will make Michigan the 10th state to permit recreational marijuana use. Missouri and Utah voted to legalize medical marijuana. In total, 33 U.S. states have now legalized marijuana in some form. North Dakotans, however, voted against a measure that would allow recreational weed.

Analysts say the legalization vote in Michigan could create a marijuana market whose value eventually exceeds $1 billion. Robert Fagan, an analyst at GMP Securities, said the Democratic control of the House represented a "fundamental shift in the U.S. legislative landscape which could usher in a period of positive cannabis reforms."

He noted that Democrats will control the House Rules Committee, which had blocked cannabis reform bills under the leadership of Pete Sessions, an anti-pot Texas Republican who lost his re-election bid. Still, Fagan said, the GOP's ability to retain control of the Senate could represent a hurdle to more pot-friendly legislation. IBD |

| Esports China esports victory points to lofty ambitions in nascent sector

China has an undistinguished record in international team sports, from football to basketball to ice hockey, but it has been peerless in one competition this year. Chinese teams have won every major tournament this year in League of Legends, the world’s most-played video game, and clinched the world championship last weekend.

Invictus Gaming, the Chinese team, thrashed its European rival Fnatic 3-0, taking home the giant silver “Summoner’s Cup” and more than $840,000 in prize money. A global audience of at least 200m fans tuned in to watch the final, according to Chinese streaming companies.

The rise of esports in China has been even more dramatic than elsewhere. Until 2015, video games consoles were banned by a government that remains uneasy about the effect of screentime on the development of children. This year, no new games have been licensed for commercialisation since March. Nevertheless, money has poured into Chinese esports, and the country now has a pivotal influence in the global market. Tencent, the world’s largest video games company, expects China will have 60 per cent of the world’s players in two years.

Esports will generate $906m in revenue globally this year, according to consultancy NewZoo, while a Goldman Sachs projection suggests 35 per cent annual growth and a revenue figure of $2.96bn in 2022. FT |

|

|

|

|

| |

| Technology |

| Semiconductors Skynet, The First Blockchain on Chip — Road to Blockchain IoT Device Interconnectivity

The Skynet project is a global and scalable end-to-end solution for interconnected IoT devices. The project not only consists of a high transaction throughput and secure blockchain communication infrastructure but also includes a specialized blockchain on chip hardware solution. The BoC provides both blockchain-ready components and artificial intelligence (AI) acceleration. To this end, the chip contains a cold-storage cryptocurrency wallet, hash acceleration, and automatic transaction signing hardware.

Today, most chips used in connected devices are based on ARM designs. Because of this monopoly, ARM is in a position to charge between 1 and 10 million USD upfront for ARM-based chip licensing. They also earn between 1 and 2 % in royalties on every chip sold.

It is only recently that alternatives have become available. In the same way, open source software has managed to break up software monopolies, the RISC-V foundation promotes a free and open instruction set architecture for processor cores. RISC-V can be used as a license-free basis for modern system on a chip designs.

Skynet, with over 15 patent-pending innovations, plans to leverage and add its IP to this alternative in order to provide a license-free blockchain- and AI-ready chip solution. Skynet Core aims to replace existing processor cores to provide a fully integrated solution for tomorrow’s machine-to-machine (M2M) economy. M |

| Semiconductors New semiconductor paves the way to super powerful, greener phones

Australian engineers have brought bendable, biodegradable screens a step closer with an ultra-thin, part-organic semiconductor. According to Australian National University (ANU) researcher and PhD student Ankur Sharma, the hybrid organic-inorganic semiconductor material can convert electricity to light very efficiently and be grown as thin as 2 nm or less – tens of thousands of times thinner than a human hair. This makes it a candidate for future flexible electronic devices.

Sharma and his supervisor, Associate Professor Larry Lu, used a process called chemical vapour deposition to manufacture their semiconductor material. This involved heating molecules at one end of a vacuum tube, and using a gas to deposit them one by one into a precise location on a chip. “It’s very similar to 3D printing – growing everything from bottom up, but with atoms,” Sharma explained.

Sharma explained the new material also has the potential to supercharge the processing power of mobile devices. Today’s phones use electricity alone to process information, but this new semiconductor is optoelectronic. This means it uses a mixture of light and electricity. As light is faster than electricity, processors using optoelectronic semiconductors would be much speedier than conventional processing tech. create

|

| Semiconductors Chinese companies rush to make own chips as trade war bites

Chinese high-tech companies are rushing to produce their own semiconductors as rising trade and security tensions with the U.S. increase the risk that supplies from outside may be squeezed.

Internet search engine operator Baidu, e-commerce giant Alibaba Group Holding and household electronics maker Gree Electric Appliances are among those who have moved into chip development as Washington attempts to curb China's growing influence in cutting edge technologies. "China has relied on imports for high-performance chips, but that can change in the age of artificial intelligence," Baidu CEO Robin Li recently said.

Despite being the world's largest semiconductor market, making up 40% of the global market on a value basis, China sources only 10% of its chips domestically, according to domestic media. China's semiconductor imports totaled $260 billion last year, beating the tally for oil.

President Xi Jinping has called for self-reliance in the industry after the U.S. cracked down on trade with certain high-tech Chinese companies. The leader has set a target of boosting the ratio to 40% domestic production by 2020 and 70% five years later. However Chinese companies could still face obstacles as the U.S. has now begun to crack down on the export of vital chip-making equipment. NAR |

| Semiconductors U.S. court rules Qualcomm must license technology to rivals

The preliminary ruling came in an antitrust lawsuit against Qualcomm brought by the U.S. Federal Trade Commission in early 2017. The lawsuit is scheduled to go to trial next year. The preliminary ruling by Judge Lucy Koh in the U.S. District Court for the Northern District of California said that Qualcomm must license some patents involved in making so-called modem chips, which help smart phones connect to wireless data networks, to rival chip firms.

It was not immediately clear whether the ruling would affect the settlement talks. Qualcomm shares were down about 0.3 percent to $63.26 after the news.

Settling with U.S. regulators would be a turning point for the San Diego chip firm, which has been defending its business model amid lawsuits from large customers such as Apple Inc (AAPL.O) and Huawei Technologies Inc, as well as dealing with regulatory challenges to its practices around the world.

At issue in the civil litigation and regulatory disputes is whether Qualcomm’s patent licensing practices, when combined with its chip business, constitute anticompetitive behavior. Regulators in South Korea and Taiwan initially ruled against Qualcomm, but it has appealed the rulings and settled some of them.

In August, Qualcomm settled with Taiwanese regulators for $93 million and an agreement to invest $700 million in the country over the next five years. R |

| Semiconductors Merrill Lynch Says Now’s Your Chance to Buy 4 Semiconductor Giants

For years, the semiconductors were big sector leaders, and with good reason. The increase in uses for a wide variety of chips in everything from cars to industrial to video gaming made demand jump. While the demand skyrocketed, so did the need for the machines that make and calibrate semiconductors. Last month the semiconductors and capital equipment stocks were shown the way to the woodshed, where they took a beating.

In a recent research report, Merrill Lynch noted that October data showed that the semiconductor weighting versus the S&P 500 held at a 1.1 times figure, compared with a much higher peak of 1.46 times in March of 2017. Versus overall technology, semiconductors are equal weight, and below electronic equipment, software and information technology services.

This data suggest to the analysts that there is a big-time opportunity for investors, and they focused on four companies that are all rated Buy at Merrill Lynch but are currently underweighted and under-owned. While better suited for risk-tolerant growth accounts, they could bring some outstanding year-end gains. 247WallStreet |

|

|

|

|

| |

| Commodities |

| Cobalt Cobalt mine sales halt to push up price of key electric car metal

A sales halt at one of the world’s largest cobalt mines is set to push up prices of the metal whose demand has surged in recent years with the advent of electric cars. The Glencore-run mine, located in the Democratic Republic of Congo, ceased sales on Tuesday after it found traces of the nuclear fuel uranium on the site.

Katanga Mining, a unit of Glencore that was set to become the largest source of cobalt in the world next year, said the amount of uranium had exceeded the limit allowed to truck cobalt out of the DRC to the port, though it added that it did not pose a health risk.

Cobalt prices have fallen this year due to the growth of mine supply in the DRC, which produces more than 60 per cent of the world’s supply of the metal. However, demand is set to double over the next few years due to its use in lithium-ion batteries in electric cars.

Carmakers such as Tesla are reducing the amount of cobalt they use in their batteries, but eliminating it entirely is proving difficult due to safety issues. Cobalt plays a key role in providing stability to the battery, allowing it to be charged and discharged continually without problems. FT |

| Lithium Lithium Market `Problematic' on Project Delays, Livent CEO Says

The lithium industry’s struggle to match booming demand for the rechargeable-battery ingredient is “problematic” and will further tighten the market, according to the only lithium pure-play trading in New York.

“It’s almost impossible for me to see a meaningful decrease” in lithium prices, Livent Corp. Chief Executive Officer Paul Graves said in a telephone interview Tuesday after the company presented quarterly earnings. “Whenever you have less supply than expected, it will create more tightness.”

Santiago-based SQM was the latest lithium producer to report a project delay as suppliers react to global demand that, according to Graves, probably will quadruple by 2025 as electric-vehicle sales accelerate.

Livent, spun off from chemicals giant FMC Corp. and listed on the New York Stock Exchange last month, is also planning to expand operations at the Hombre Muerto salt flat in Argentina. The company has all the approvals it needs to start construction there, Graves said. Livent will ramp up its first 9,500-ton-per-year expansion in the second half of 2020 and will work toward three more expansions of similar size through 2024. B |

|

|

|

|

|

| |

| Energy & Environment |

| Batteries BNEF raises forecast for global battery deployment to $1.2T by 2040

The price of lithium-ion batteries is declining faster than anticipated, causing Bloomberg New Energy Finance (BNEF) to significantly increase its forecast for global deployment energy storage, both behind-the-meter and grid-scale.

BNEF now believes the global energy storage market, which excludes pumped hydro, will grow to a cumulative 942 GW / 2,857 GWh by 2040, "attracting $1.2 trillion in investment over the next 22 years."

By 2040, BNEF expects storage will represent 7% of the total installed power capacity globally. And while most storage capacity is now utility-scale, the firm expects that in the mid-2030s behind-the-meter storage will dominate deployments.

In 2016, BNEF forecast the energy storage market could be valued at $250 billion or more by 2040 with 25 GW of the devices deployed by 2028. Last year, the firm predicted storage capacity rising to a total of 125 gigawatts/305 gigawatt-hours by 2030.

BNEF predicts that by 2040, nine markets will represent two-thirds of the installed global capacity: China, the United States, India, Japan, Germany, France, Australia, South Korea and the U.K. While China is expected to lead installations throughout the 2040s, South Korea is expected to dominate today's market. The U.S. will lead in the early 2020s, BNEF believes, before it is overtaken by China later in the decade. UDive

|

| Fuel Cells Soda Can Metal May Solve Hydrogen Fuel Cell Problem

Manganese is known for making stainless steel and aluminum soda cans. Now, researchers say the metal could advance one of the most promising sources of renewable energy: hydrogen fuel cells. As reported in Nature Catalysis, the discovery could eventually help solve hydrogen fuel cells’ most frustrating problem: they’re not affordable because most catalysts are made with platinum, which is both rare and expensive.

“We haven’t been able to advance a large-scale hydrogen economy because of this issue involving catalysts,” says lead author Gang Wu, associate professor of chemical and biological engineering at the University at Buffalo. “But manganese is one of the most common elements in Earth’s crust and it’s widely distributed across the planet. It could finally address this problem,” Wu says.

In experiments reported in the study, he devised a relatively simple two-step method of adding carbon and a form of nitrogen called tetranitrogen to manganese. The result was a catalyst that’s comparable in its ability to split water—the reaction needed to produce hydrogen—as platinum and other metal-based alternatives.

More importantly, the stability of the catalyst makes it potentially suitable for hydrogen fuel cells. This could lead to wide-scale adoption of the technology in buses, cars, and other modes of transportation, as well as backup generators and other sources of power. Futurity |

| Fusion MIT Plans New Fusion Reactor That Could Actually Generate Power

For decades, experimental reactors have achieved fusion at low levels, but never has there been net power generation. MIT says it has the tools to make true fusion power happen, and it may be producing energy in a few years.

MIT has made several significant advances toward usable fusion power in recent years, like the technique to vent excess heat from fusion reactors. The latest innovation is a type of high-temperature superconductor (HTS) that can make electromagnets more powerful. The team behind the “Sparc” reactor project at MIT believes this will be the difference between wasting and generating power with fusion.

The Sparc reactor proposed by MIT isn’t dramatically different than other tokamak fusion devices from previous experiments. You start with deuterium and tritium, both isotopes of hydrogen. When heated to high temperatures, it forms a plasma that the reactor confines within a magnetic field encircling the toroidal chamber of the reactor. The high heat and pressure cause some of the atoms to undergo fusion and release energy.

MIT’s Sparc team predicts its reactor could be capable of producing 50-100 megawatts of fusion power as soon as 2025. That’s still a far cry from what a modern nuclear fission plant can produce — those are often measured in thousands of megawatts. Still, it would be a significant step toward making fusion power viable. ExTech |

| Renewables Non-Hydro Renewables To Replace Nuclear In Germany, Reaching 71.9% By 2030

With Germany set to phase out its nuclear capacity by 2022, leading analysts GlobalData predicts that non-hydro renewables will almost exclusively fill the remaining capacity, and by 2030 will contribute over 70% to the country’s power mix.

GlobalData published a new report last week which claims non-hydro renewables will almost exclusively replace nuclear energy in Germany as the country phases out the technology, bolstered by recent renewable growth which already contributes a significant percentage of Germany’s power mix. Specifically, in 2017, onshore wind power capacity accounted for the largest share of installed capacity in Germany with 24.1%, followed by coal with 22.1% and then solar PV with 20.2%. All up, non-hydro renewables contributed over half (51.6%) of Germany’s total installed power capacity in 2017.

Looking forward, GlobalData sees Germany focusing on expanding its offshore wind and geothermal power sectors, which are expected to increase at a rate of 8.7% and 9.9% respectively. Conversely, thermal capacity is expected to decline from its current levels of 38.4% to only 23.2% by 2030, due primarily to a reduction in coal-fired capacity. CT

|

| Renewables Scottish utility goes 100% renewable, pushes electric vehicles too

ScottishPower—one of the UK's so called "Big Six" energy utilities—has long been at the forefront of wind energy development. But while it was once considered just one part of a wider, more conventional energy portfolio, renewable energy has become so competitive, so fast, that ScottishPower recently made the important move of ditching fossil fuels entirely.

Of course, in some ways nothing actually changed. ScottishPower sold its last remaining gas plants to Drax, which will continue to operate them and churn out the emissions associated with them too. But as the press release emphasizes, the move makes them the "first integrated energy company in the UK to shift completely from coal and gas generation to wind power."

Just a month later, the energy giant is now pushing hard on electric vehicle charging too. Through a deal with UK private car dealership Arnold Clark prospective EV buyers will be able to purchase or lease an EV of their choice, book a home charging point installation, and sign up to a 100 per cent renewable electricity tariff as part of the same package.

The UK has already made significant progress in slashing energy-related carbon emissions to Victorian-era levels, which puts it in good stead to reap the full environmental benefits of electrifying transportation. TreeHugger |

| Renewables Global Floating Solar Capacity Surpasses 1 Gigawatt

We have been hearing about floating solar projects for a while now — and they have become particularly popular in Asia, where the local topography is more likely to provide ideal locations for the combination of water and solar. According to the new report published by the World Bank, Where Sun Meets Water, floating solar is “particularly promising” for the fast-growing economies of Asia, and interest has been high in places like China, India, and Southeast Asia.

According to the report, “capacity for floating solar is growing exponentially” — a fact borne out by the figures; specifically, at the end of 2014, total global floating solar capacity had only reached 10 megawatts (MW), but as of September 2018, that figure had increased more than 100-fold to 1.1 GW.

In addition to providing renewable energy generation, floating solar has the added benefit of working well with other projects — be they hydropower projects or agricultural systems. The report also outlines the regional potential, which is primarily led by North America, followed by the Middle East & Asia, and Africa. CT |

|

|

| Utilities Siemens Says AI Can Boost Power Plant Profit by 20%

Companies from health care to power generation that adopt a “data-centric business strategy” can improve efficiency and achieve higher profitability, Andreas Geiss, chief technology officer and vice president at Siemens Mindsphere, part of Siemens AG, told BloombergNEF in an interview. “Manufacturers who don’t invest in digitalization will miss the next quantum leap”, Geiss said.

Siemens and U.S. software company Bentley Systems launched a joint service in October to provide asset performance analytics of power plants aimed at improving energy network usage and cutting costs. It is hosted on Siemens’ cloud-based system MindSphere and uses artificial intelligence to help understand the performance of a power plant such as a wind farm.

The technology may suggest operational changes, such as how to “manipulate the pitch of the blades for higher electricity output, or turn down the electricity output of the plant during low demand periods in order to gain lifetime for the wind turbines,” Geiss said. “Improving overall equipment efficiency by 10 percent can result in bottom-line improvements of 20 percent and more,” he added. BNEF |

|

|

|

|

| |

| Endnote |

| US Housing Home prices rise in September, but slowdown is on the horizon

Home prices have been creeping steadily upward since 2012. However, according to CoreLogic, home prices will only increase by 4.7% between now and September 2019. While in the past many states have seen home values grow by more than 10% in a month, only Texas and Nevada saw such double-digit growth (12.8% and 11.9%, respectively) this September. inman |

|

|

|

|

|

| |

| About the DIBs and McAlinden Research Partners

McAlinden Research Partners (MRP) publishes daily and other periodic reports on the economy and the markets.

MRP focuses on identifying change in the global economy and offering an investment thesis whenever an opportunity arises that has not yet been recognized by the market. The DIBs are MRP's compilation of articles and data from multiple sources on subjects reflecting change that have potential investment implications for an industry or group of securities. We share these with our clients who may already have or may be considering exposure in the industries affected. The subjects change daily and constitute an excellent update on featured topics. |

|

|

| The information provided in this Report is not to be reproduced or distributed to any other persons. This report has been prepared solely for informational purposes and is not an offer to buy/sell/endorse or a solicitation of an offer to buy/sell/endorse Interests or any other security or instrument or to participate in any trading or investment strategy. No representation or warranty (express or implied) is made or can be given with respect to the sequence, accuracy, completeness, or timeliness of the information in this Report. Unless otherwise noted, all information is sourced from public data.

McAlinden Research Partners is a division of Catalpa Capital Advisors, LLC (CCA), a Registered Investment Advisor. References to specific securities, asset classes and financial markets discussed herein are for illustrative purposes only and should not be interpreted as recommendations to purchase or sell such securities. CCA, MRP, employees and direct affiliates of the firm may or may not own any of the securities mentioned in the report at the time of publication. |

|

|

|

|

|

|

|

|