To go to MRP's research library, click here. |

|

|

|

|

|

|

Wednesday, November 10, 2021 |

|

|

Coverage of of the day's most critical data releases and news stories |

|

|

|

|

THEMATIC SIGNALS

Aggregation of key events and breaking stories monitored by MRP |

|

|

Banks: Bank Stocks Have Been Big Winners. There’s More Upside in 2022. |

Homebuilders: Building and Renting Single-Family Homes Is Top-Performing Investment |

Cannabis: Green Thumb sales surge on growing U.S. cannabis demand |

Satellites: Viasat buying Inmarsat in $7.3 billion deal |

Autonomous Vehicles: Walmart is using fully driverless trucks to ramp up its online grocery business |

Renewables: S&P Global Market Intelligence energy outlook says record wind and solar generation additions set to make 2022 a big year as the energy transition continues to gain pace |

Gene Editing: Beam gets green light to begin first clinical test of base editing |

|

|

|

|

MACROECONOMIC INDICATORS

Analyzing all of the most critical data points from around the globe |

|

|

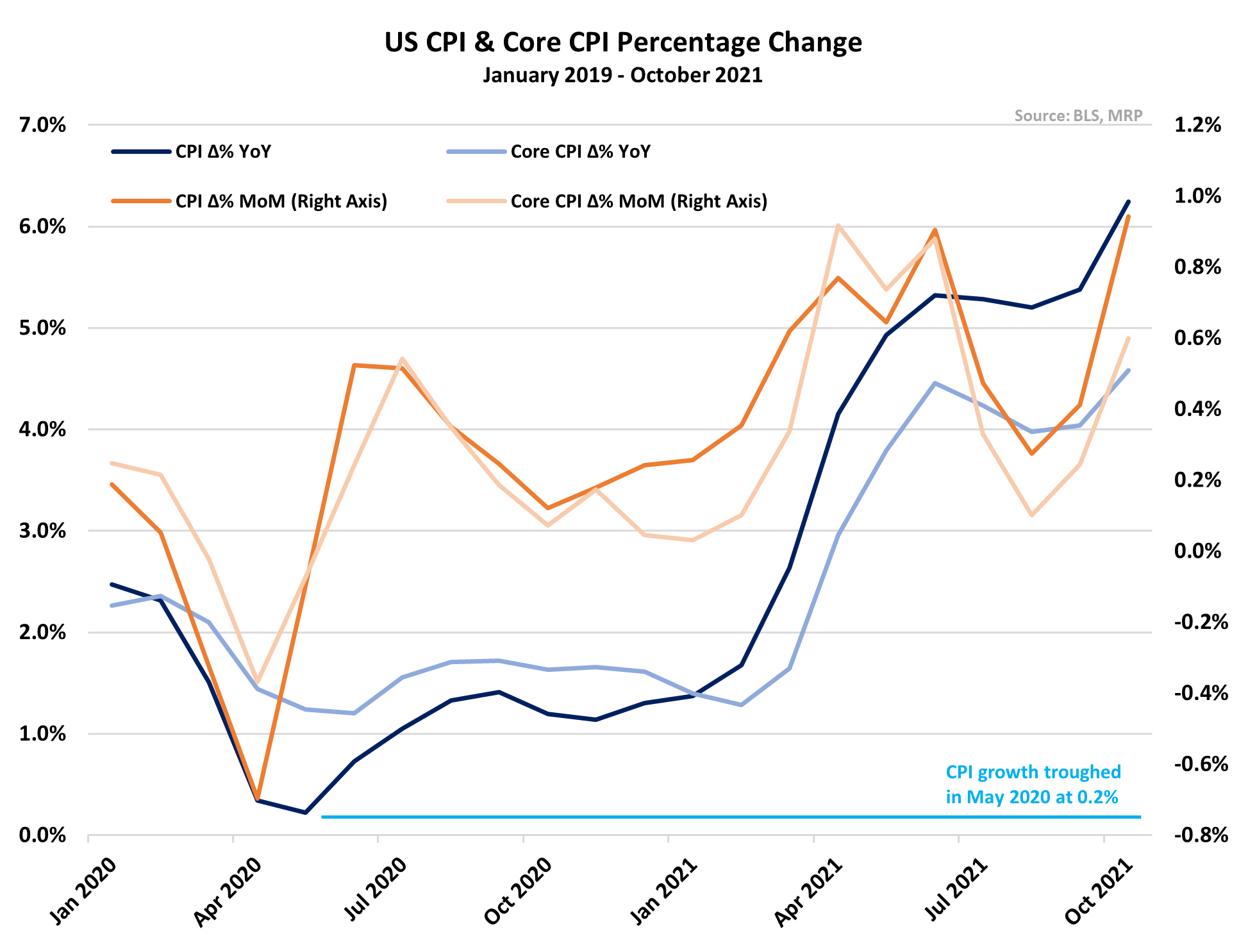

US CPI Rises to Highest Level Since 1990

The YoY rise in the US Consumer Price Index (CPI) surged to 6.2% in October of 2021. That marks the highest rate of price inflation since November of 1990. The reading was above forecasts of 5.8%. The monthly rate increased to 0.9% from 0.4% in September.

Core CPI (all items less food and energy) growth also advanced to a multi-decade high, advancing 4.6% YoY. |

|

|

|

|

|

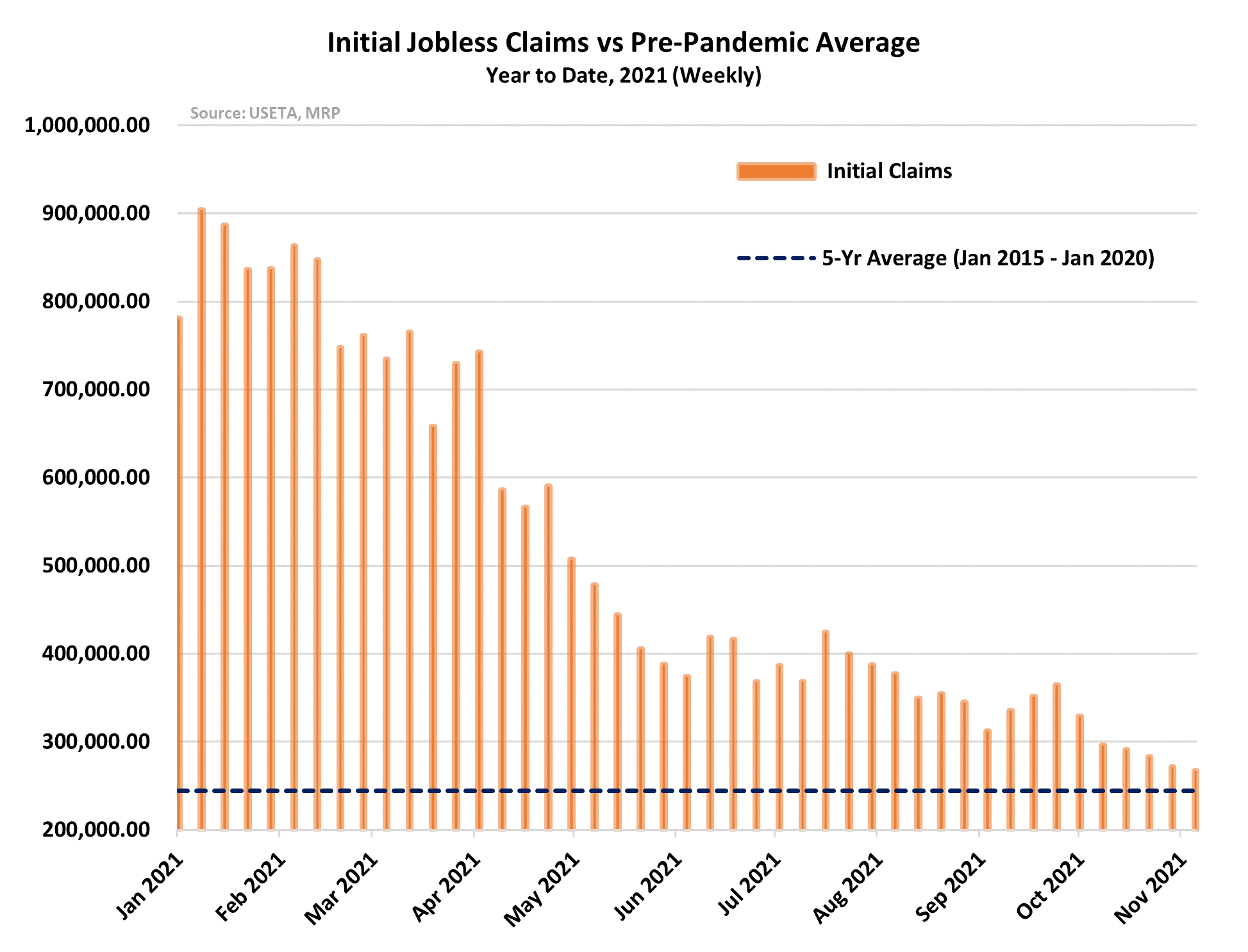

US Initial Jobless Claims Make Another New Low

The number new claims for unemployment benefits decreased to 267,000 in the week ending November 6th. That's the lowest level since the COVID-19 pandemic sent the unemployment rate soaring in early 2020.

The latest reading also showed new claims just slightly above the average level between 2015 and the start of the pandemic. |

|

|

|

|

|

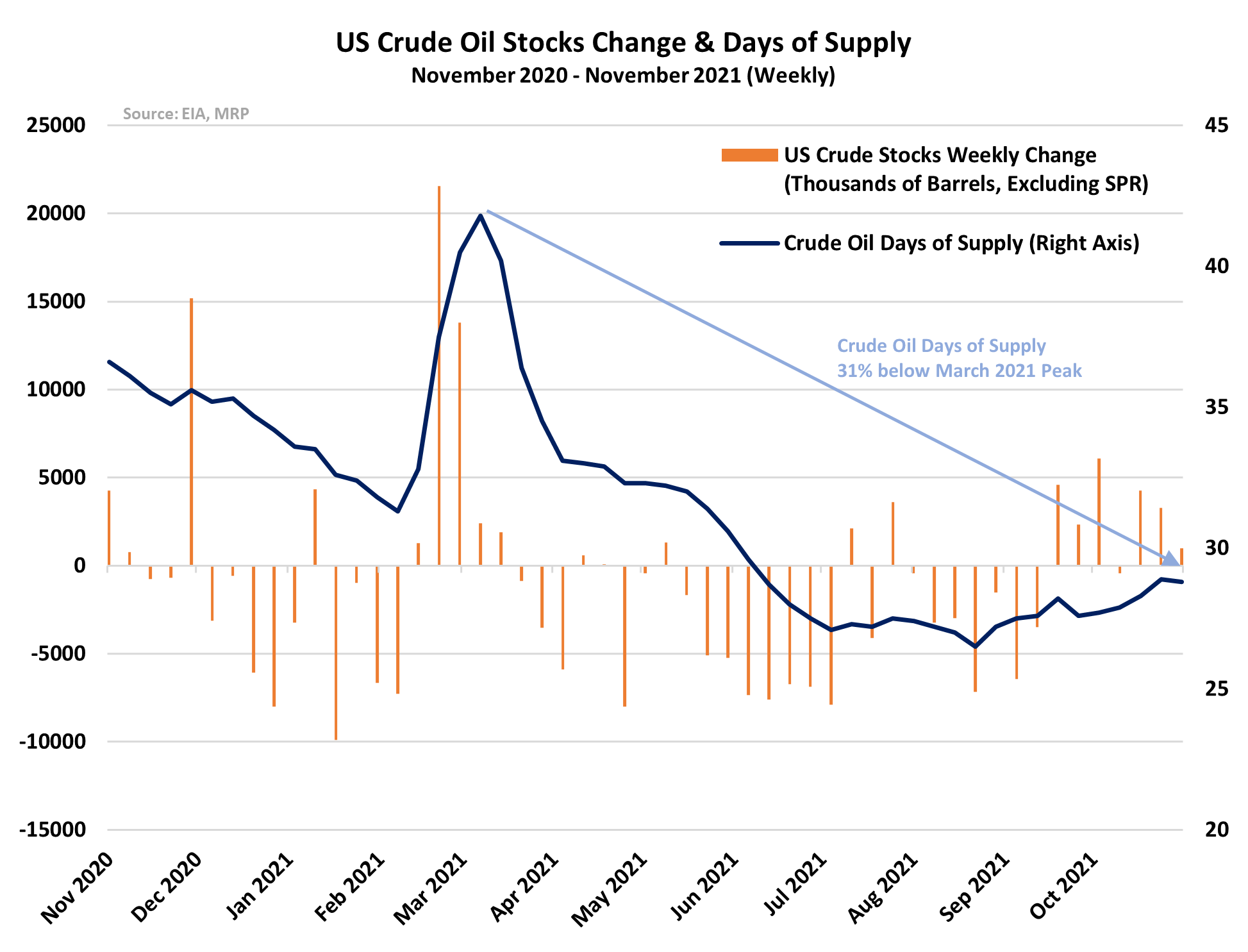

US Crude Oil Stocks Build Again, But Diverge With Gasoline Supply

US crude oil inventories rose by 1.001 million barrels in the week ending November 5th. That was below market forecasts of a 2.125 million increase, but marked the 6th build in the last 7 weeks.

Despite the recent rebound in US crude oil stockpiles, the EIA's measure of days of supply is still more than a third below the 2021 peak. Additionally, gasoline stocks dropped by 1.555 million barrels - a fifth consecutive decline.

|

|

|

|

|

|

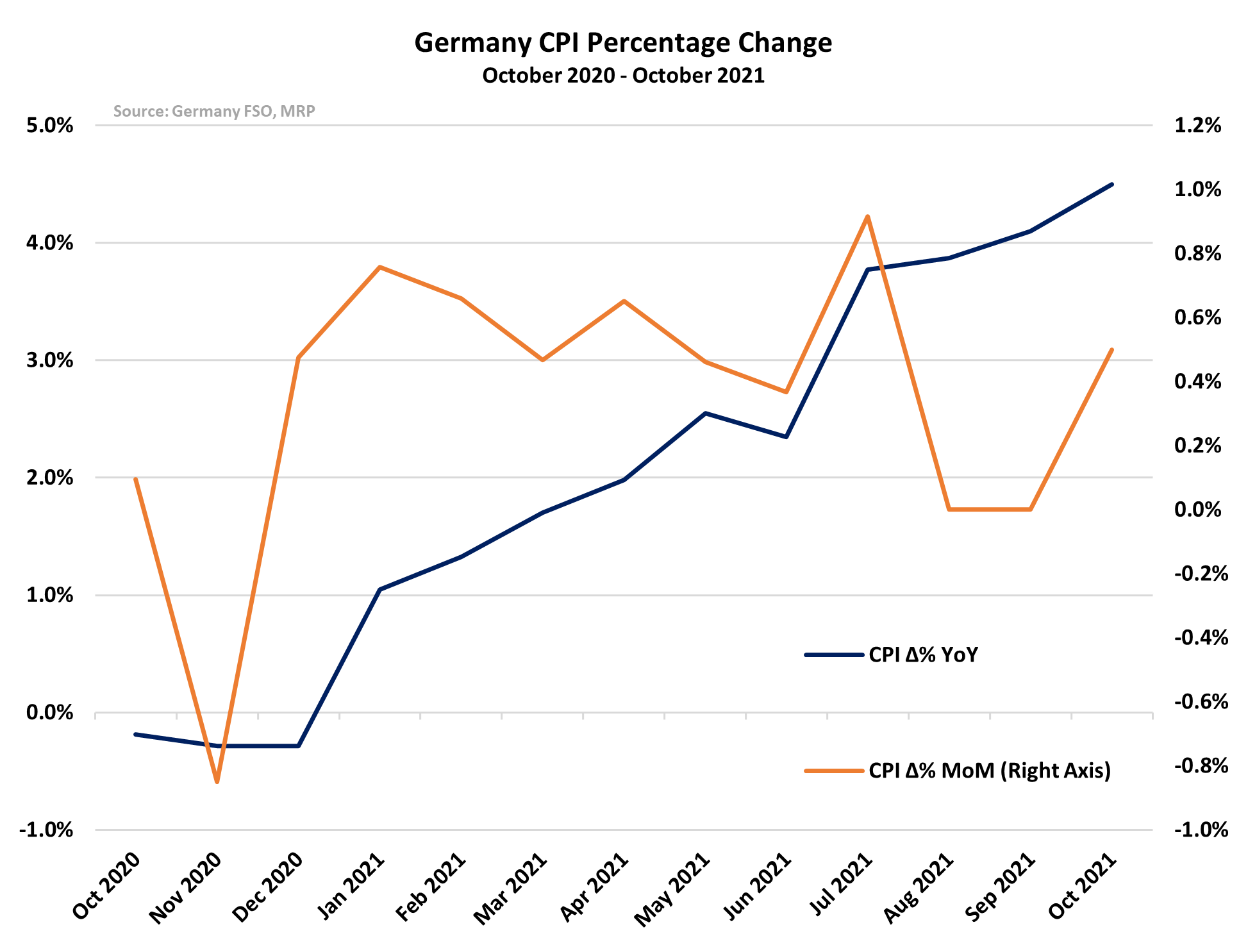

Germany Inflation Data Shows Price Pressures Back on the Rise

Annual price growth in Germany rose to 4.5% in October 2021, the highest rate since August 1993. Inflation jumped to 0.5% MoM after two months at 0.0%. |

|

|

|

|

|

BLOCKCHAIN BREAK Monitoring on-chain data points across digital assets |

|

|

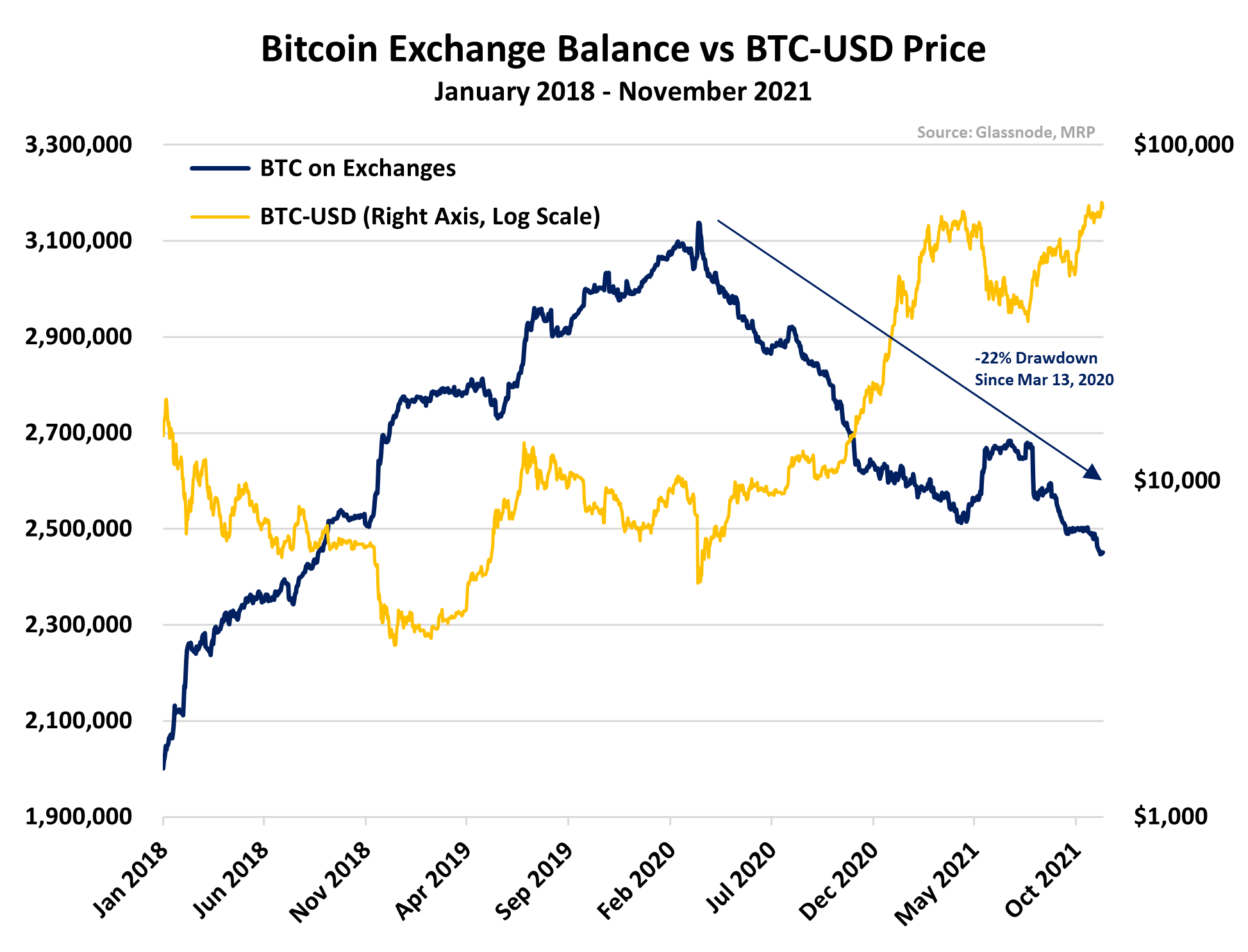

Bitcoin (BTC) Balance on Exchanges Heads Toward 3-Year LOW

There is currently less than 2.5 million BTC (~$163 billion) remaining on exchanges tracked by Glassnode. That is down more than 22% from the 2021 peak above 3.1 million in February.

The 2,450,781.95 BTC held on exchanges on November 6 marked the lowest level Sine 2018.

See More in our FREE Weekly Crypto Wrap +

|

|

|

|

|

|

THEMATIC SIGNALS: SUMMARIES |

|

|

|

|

Banks Bank Stocks Have Been Big Winners. There’s More Upside in 2022.

Analysts at Oppenheimer note that the Treasury yield curve is forecasting at least one or two rate hikes by 2023, adding that the first hikes are the most “consequential” for banks. Two rate hikes would translate into a 5% increase in net interest income, according to Oppenheimer analyst Chris Kotowski.

A second catalyst for bank stocks, Oppenheimer also forecasts loans to grow 3% annually through 2023.

Read the full article from Barron's + |

|

|

|

|

Construction & Real Estate |

|

|

Homebuilders Building and Renting Single-Family Homes Is Top-Performing Investment

Rents on homes are rising faster than ever. New household formation is also increasing the demand for rentals, as more young people get their own places. The expected risk-adjusted annual return for built-to-rent investments in the private market is now about 8% on average, according to securities advisory Green Street, the highest of 18 property sectors tracked by the firm.

Traditional home builders like Lennar Corp. and D.R. Horton Inc. have made building rental houses a major component of their business.

Read the full article from The Wall Street Journal + |

|

|

|

|

|

|

Cannabis Green Thumb sales surge on growing U.S. cannabis demand

U.S. cannabis producer Green Thumb Industries Inc's third-quarter revenue surged nearly 49% to beat estimates on Wednesday. Chicago-based Green Thumb's profit more than doubled to $20.2 million, or 8 cents per share.

Chief Executive Officer Ben Kovler estimated the U.S. cannabis industry is currently worth $24 billion in annual sales, in line with independent research data, and expects it could triple in size over the next decade as new states, products and consumers enter the market.

Read the full article from Reuters + |

|

|

|

|

|

|

Satellites Viasat buying Inmarsat in $7.3 billion deal

Viasat has agreed to buy British satellite fleet operator Inmarsat in a $7.3 billion deal to expand its broadband network globally in multiple orbits and spectrum bands.

Buying private equity-backed Inmarsat would transform U.S.-based Viasat into an operator of 19 satellites across Ka, L and S-band spectrum — with another 10 spacecraft set to launch in the next three years for a market that has been shaken up by SpaceX’s Starlink and other incoming megaconstellations.

Read the full article from Space News+ |

|

|

|

|

|

|

Autonomous Vehicles Walmart is using fully driverless trucks to ramp up its online grocery business

Walmart said Monday it has started using fully driverless trucking in its online grocery business, aiming to increase capacity and reduce inefficiencies.

Walmart and Silicon Valley start-up Gatik said that, since August, they’ve operated two autonomous box trucks — without a safety driver — on a 7-mile loop daily for 12 hours Gatik said its autonomous vehicles can also reduce logistics costs by as much as 30% for a grocery business.

Read the full article from CNBC + |

|

|

|

|

|

|

Renewables S&P Global Market Intelligence energy outlook says record wind and solar generation additions set to make 2022 a big year as the energy transition continues to gain pace

"It's going to be a record year for renewable energy development in the U.S. in 2022, with 44 GW of solar and 27 GW of wind power set to be installed alongside more than 8 GW of battery storage," said Richard Sansom, Head of Commodities Research at S&P Global Market Intelligence.

US utility capex is expected to remain on the upswing, with investments in upgrading and modernizing the country's aging energy and water infrastructure reaching $63 billion and utility renewables spending surpassing $14 billion in 2022.

Read the full article from PR Newswire+ |

|

|

|

|

Biotechnology & Healthcare |

|

|

Gene Editing Beam gets green light to begin first clinical test of base editing

The Food and Drug Administration will allow Beam Therapeutics to proceed with the first clinical trial testing base editing, a new type of gene editing. The Phase 1/2 study will test BEAM-101, a therapy designed to treat sickle cell disease by reactivating a form of the oxygen-carrying protein hemoglobin that normally disappears soon after birth.

Base editing is a more precise form of gene editing than CRISPR, designed to alter single DNA "letters" rather than larger strips of genetic code, and does so without breaking both strands of the DNA double helix.

Read the full article from BioPharmaDive + |

|

|

|

|

|

|

|

|

|

|

|

ABOUT THE DIBS AND MCALINDEN RESEARCH PARTNERS

McAlinden Research Partners (MRP) publishes daily and other periodic reports on the economy and the markets.

MRP focuses on identifying change in the global economy and offering an investment thesis whenever an opportunity arises that has not yet been recognized by the market. The DIBs are MRP's compilation of articles and data from multiple sources on subjects reflecting change that have potential investment implications for an industry or group of securities. We share these with our clients who may already have or may be considering exposure in the industries affected. The subjects change daily and constitute an excellent update on featured topics. |

|

|

The information provided in this Report is not to be reproduced or distributed to any other persons. This report has been prepared solely for informational purposes and is not an offer to buy/sell/endorse or a solicitation of an offer to buy/sell/endorse Interests or any other security or instrument or to participate in any trading or investment strategy. No representation or warranty (express or implied) is made or can be given with respect to the sequence, accuracy, completeness, or timeliness of the information in this Report. Unless otherwise noted, all information is sourced from public data.

McAlinden Research Partners is a division of Catalpa Capital Advisors, LLC (CCA), a Registered Investment Advisor. References to specific securities, asset classes and financial markets discussed herein are for illustrative purposes only and should not be interpreted as recommendations to purchase or sell such securities. CCA, MRP, employees and direct affiliates of the firm may or may not own any of the securities mentioned in the report at the time of publication. |

|

|

|

|

|

|

|

|