To go to MRP's research library, click here. |

|

|

|

|

|

|

Joe Mac's Market Viewpoint |

|

Wednesday, November 3, 2021 |

|

|

Founder Joe McAlinden’s big-picture analyses of macro issues. More about him here. |

|

|

|

The Roaring (Inflation) ‘20s |

Summary: Despite growth in the Fed’s preferred gauge of inflation exceeding 3.0% for six consecutive months, a rise unlikely to peak before year end, monetary policymakers have been content to brush off rapidly rising inflation as “transitory” for some time. Survey data shows that characterization is becoming less common among traders and consumers alike these days. One can observe the most recent spike in breakeven rates of inflation to see what kind of price pressures the bond market is now pricing in over the next decade. Further, top executives across the financial services industry are speaking out about their expectations for persistently elevated inflation – as well as the new role digital assets might play in countering an extended debasement of purchasing power.

For a PDF Version of this report, or to read on a Smartphone/Tablet, please click HERE |

|

|

Throughout the past year, MRP has expressed disagreement with Federal Reserve policymakers’ “transitory” assessment of inflation pressures. Unfortunately, Fed Chairman Jerome Powell’s bully pulpit has been one of the most influential market forces; a phenomenon we’ve referred to as “Jay’s Jedi Mind Trick”.

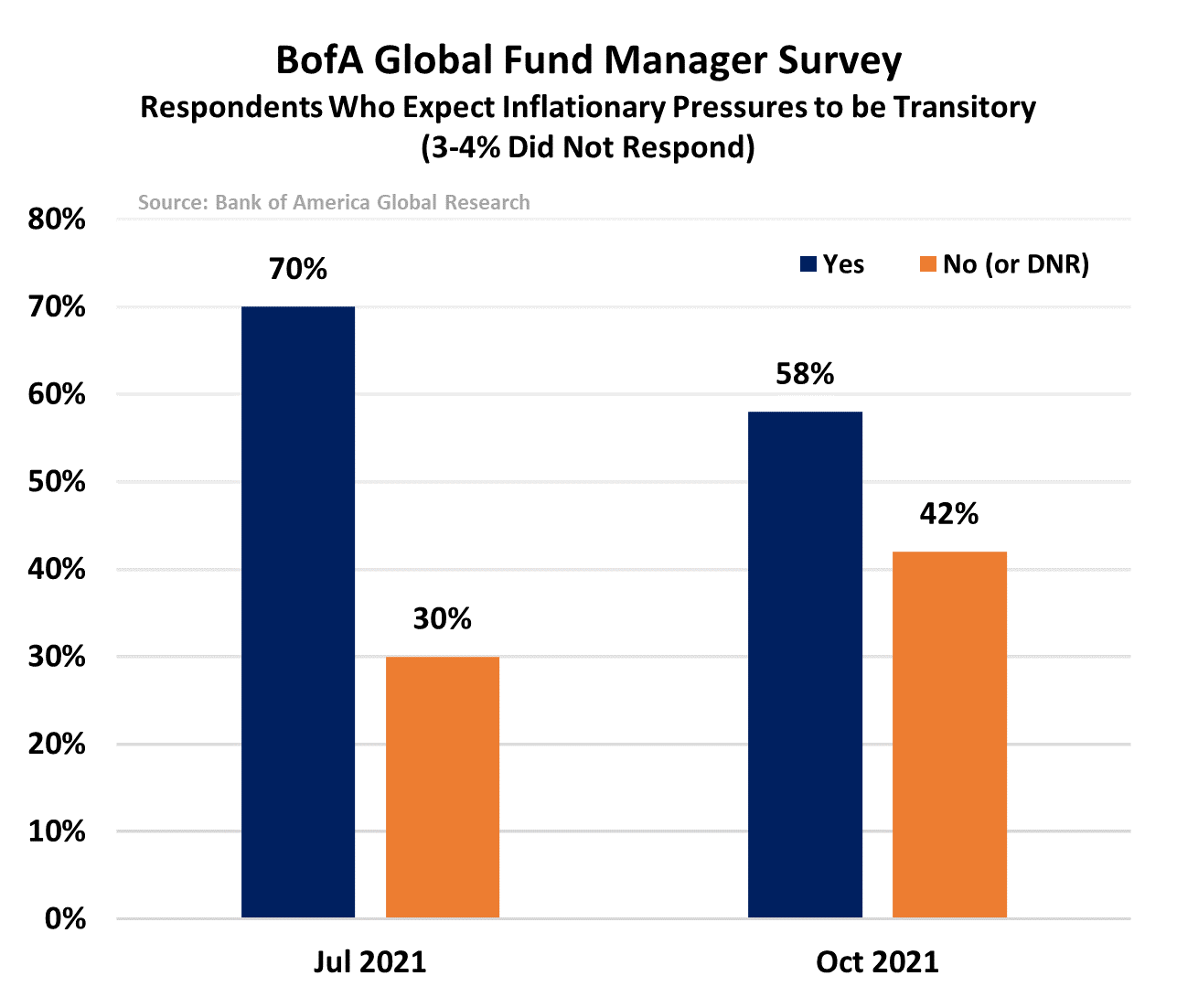

According to Bank of America’s July Global Fund Manager survey, just 22% of 239 surveyed fund managers expected inflation to rise in the next 12 months while 70% expected inflationary pressures to be transitory rather than entrenched, in line with the view of the Federal Reserve. Only 3 months later, October’s iteration of that survey showed a slimming majority of 58% think the rise in inflation is transitory. Moreover, 48% ranked inflation as the top “tail risk” – more than double the next biggest threat, China’s economic troubles, at 23%. |

|

For the most part, market participants continue to buy into to the idea that, once temporary factors like stimulus checks and supply chain disruptions dissipated, inflation would fall back toward the Fed’s 2% target. Powell isn’t the only Fed policymaker who has displayed a largely dismissive attitude toward boiling price pressures.

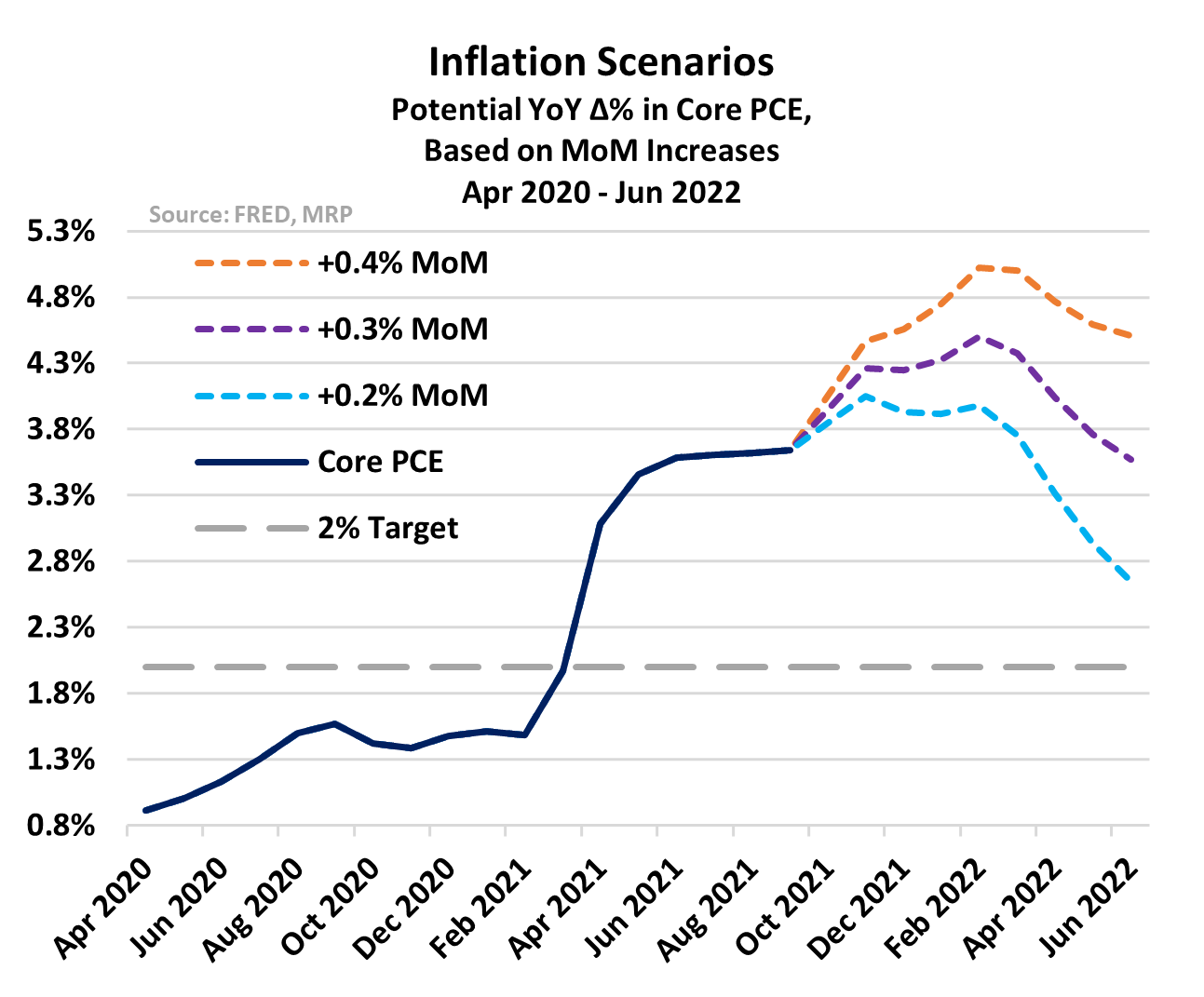

Back in March, FOMC projection materials showed the median expectation among policymakers for growth in the core personal consumption expenditures index (core PCE, the Fed’s preferred gauge of inflation) at 2.2% for 2021 – just slightly above the central bank’s target rate of 2.0%. By the time April rolled around, the Core PCE had surpassed 3.0% and has only continued to rise since then. September’s Core PCE print was north of 3.6%, the highest reading since 1991 and the sixth consecutive month that the gauge surpassed 3.0%.

Despite being way off target all throughout all of 2021, the median projection among FOMC voters continues to show their preferred inflation measure will be at just 2.3% throughout 2022. However, if month over month (MoM) prints were as low as 0.2% through the first half of 2022, the annual gain in the core PCE would remain at or above 3.8% for the duration 2021. In fact, we’d see no peak in core PCE prints until February of next year. Through June 2022, the annual gains would stay above 2.7%.

Further, if we project slightly higher 0.3% MoM gains in the Core PCE through year end, equivalent to August’s increase, we can expect a YoY reading of 4.2% by the end of 2021 and 3.6% by the end of H1 2022. Monthly increases of 0.4% would see Core PCE peak at 5.0% early next year. |

|

The problem with the assumption that inflation will peak early next year is that it doesn’t price in more massive spending plans currently brewing in Washington DC.

Though the cost of the White House’s budget reconciliation plan has been whittled down from an original price tag of $3.5 trillion to about $1.7 trillion over the next decade, it is only the latest splurge in a line of huge fiscal expenditures that have played a huge role in expanding the assets on the Fed’s balance sheet to more than $8.5 trillion. That total has more than doubled from $4.2 trillion at the start of 2020.

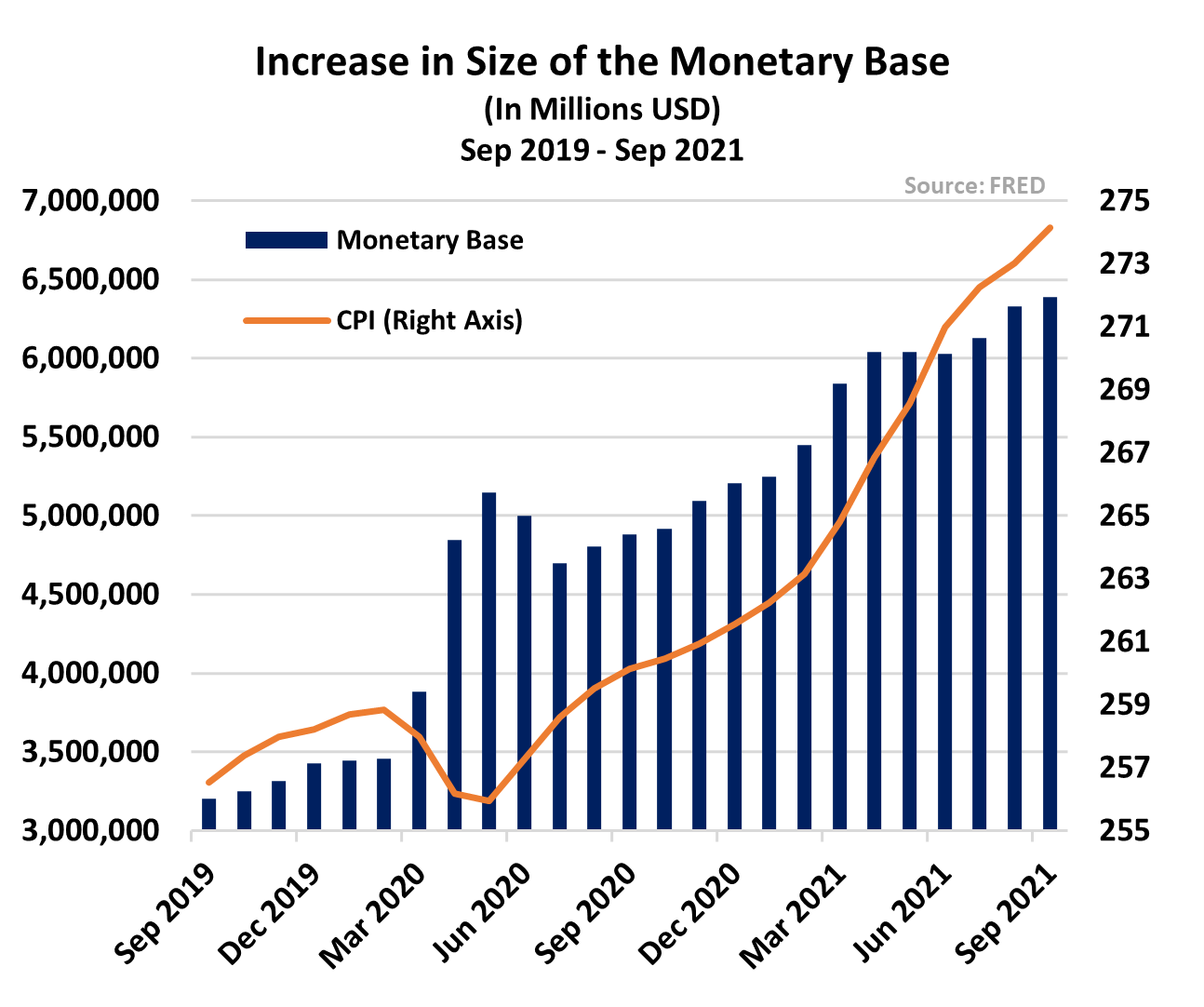

Simultaneously, the monetary base (the sum of currency in circulation and reserve balances) has also grown by 86% over that same period. Following the passage of the budget reconciliation deal, a $1.2 trillion infrastructure bill will likely be next on deck. |

|

The Fed continues to purchase $80 billion worth of treasuries every month, along with $40 billion of mortgage-backed securities (MBS). Though policymakers have signaled they will begin to taper those purchases at some point before the end of the year, it will be a gradual process. Powell announced the Fed will begin cutting purchases at a pace of $15 billion per month in November ($10 billion worth of Treasuries and $5 billion of MBS). According to that pace, we’ll still be witnessing some level of asset purchases until the middle of next summer.

As we have written before, our view is that inflation is ultimately a monetary phenomenon. The various forces, such as supply chain disruptions, post-COVID re-openings, and rising home prices can make the consumer price index calculation go up and down and drive changes in the monthly numbers, but a sustained rise in the overall number typically results from too much money chasing too few goods.

“Hyperinflation is Going to Change Everything…”

While the Fed and other public policymakers continue to downplay inflation, the consensus among private sector actors has gradually started to come around to a different view – one that prepares to counter the threat of rapidly fluctuating price pressures in the years ahead.

Jack Dorsey, co-founder of Twitter and fintech giant Square, made headlines in late October for tweeting that “Hyperinflation is going to change everything. It’s happening”. Though the tweet garnered nearly 78,000 likes, replies from mainstream economists and other financial pundits came out of the woodwork to point out that the term hyperinflation is reserved for inflation rates surpassing 50% for at least a month – a very high bar with few documented instances in recorded history. In the most literal sense, “hyperinflation” is not happening now and is unlikely to happen in the near future.

Of course, that kind of ridicule is the easy way out. What’s harder to address is the implication of what Dorsey is really saying. Inflation has already risen far beyond what was previously expected and with the current pace of monetary expansion and economic displacement it’s probably not going away. We agree, even if an inflation rate in the mid-single digits, or the 10-15% range we saw back in the 1970s-1980s, isn’t technically hyperinflation, the US appears to be headed toward a new economic paradigm that may require new solutions to address it.

Cathie Wood, founder and CEO of Ark Invest, was one of the Jack’s most prominent critics. She went so far as to assert, not only will inflation fade after the holiday season, but a wave of technology-driven deflation could follow, a decrease in prices that the US economy has not dealt with since 2015.

Perhaps the most relevant piece of information is not necessarily where Dorsey and Wood disagree, but the common ground they share. For some time, Dorsey has largely framed his concerns regarding inflation through the lens of Bitcoin (BTC) – a digital asset that some believe is an inflation hedge due to its hard-capped supply. While Wood and Dorsey disagree on his use of the H-word in regard to the US, she has noted in the past "there are a lot of emerging markets that are suffering from significant inflation – in other words, the purchasing power of those populations is going down. So they are going to migrate to Bitcoin and other ways to preserve purchasing power”.

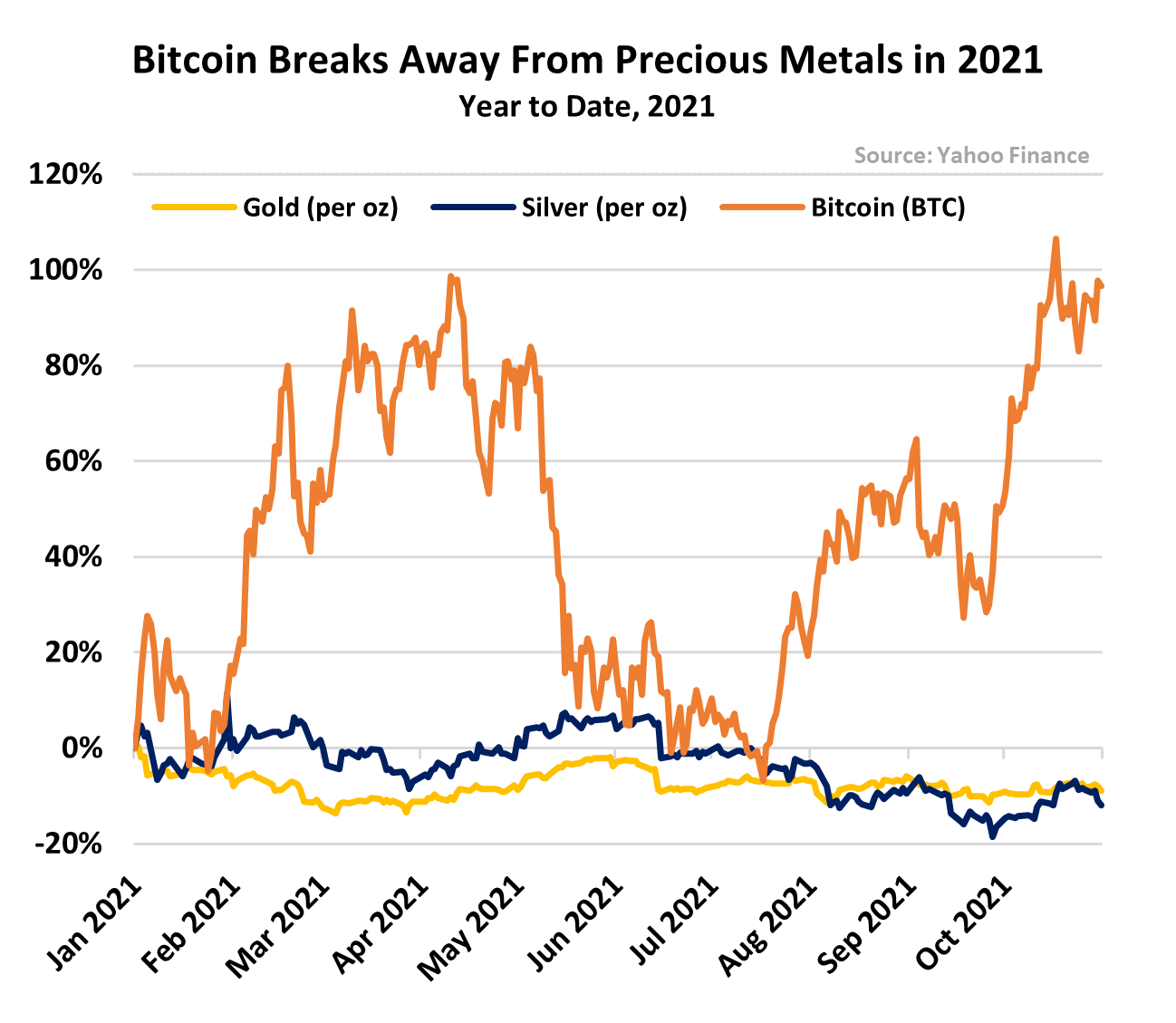

Both Wood and Dorsey are believers in BTC as a store of value, akin to a “digital” gold, and they are not the only ones.

Paul Tudor-Jones, founder of Tudor Investment Corporation, has recently referred to the ongoing wave of inflation as “the single biggest threat to financial markets”. In that same interview with CNBC, Tudor-Jones noted that “We're moving into an increasing digitized world… [cryptocurrencies are] winning the race against gold at the moment.” |

|

Peter Thiel, PayPal co-founder and Chairman of Palantir, shares that sentiment. Thiel has expressed his view that the high rates of inflation, combined with a flight of capital into Bitcoin, indicates that “we are having a crisis moment”. Palantir purchased $50.7 million of gold in August to pad their balance sheet against a so-called “black swan event” in financial markets. The company has also stated that it would also explore Bitcoin as an alternative hedge against inflation.

MRP has written extensively about Bitcoin and the digital assets space for several years now, adding LONG Digital Payments to our list of themes on February 5, 2021. Our view is that Bitcoin will continue to be an increasingly popular balance sheet asset and payment method, likely to complement gold and precious metals as opposed to replacing them. According to data from BitcoinTreasuries.net, 38 publicly traded companies including Microstrategy, Tesla, and Square now hold a combined total of 202,478 BTC (worth about $12.4 billion) on their balance sheets. Since we added our theme, the Amplify Transformational Data Sharing ETF (BLOK) has returned 36%, outperforming the S&P 500’s return of 20% over the same period.

Consumer Concerns, Breakeven Rates Climbing Higher

Consumers continue to become less optimistic about price pressures abating anytime soon. Per CNBC’s All-America Economic Survey, inflation has now tied COVID-19 as the biggest concern for Americans, up 16 points from the prior survey. A plurality of 47% of respondents believe there will be a recession in the next year, up 13 points from when the question was last asked in 2019.

Based on a University of Michigan survey of consumers, inflation expectations for the next 12 months increased to 4.8% in October, up from 4.6% in September, and 2.6% one year ago. Median expectations for inflation over the next 5 years moved only slightly lower in October, down to 2.9%, from an 8-year high of 3.0% in the prior month.

Further, the Federal Reserve Bank of New York’s Center for Microeconomic Data reported that median inflation expectations among consumers for the next year rose for the 11th straight month to 5.3%, another record high. Three-year-ahead inflation expectations increased to 4.2% from 4.0%.

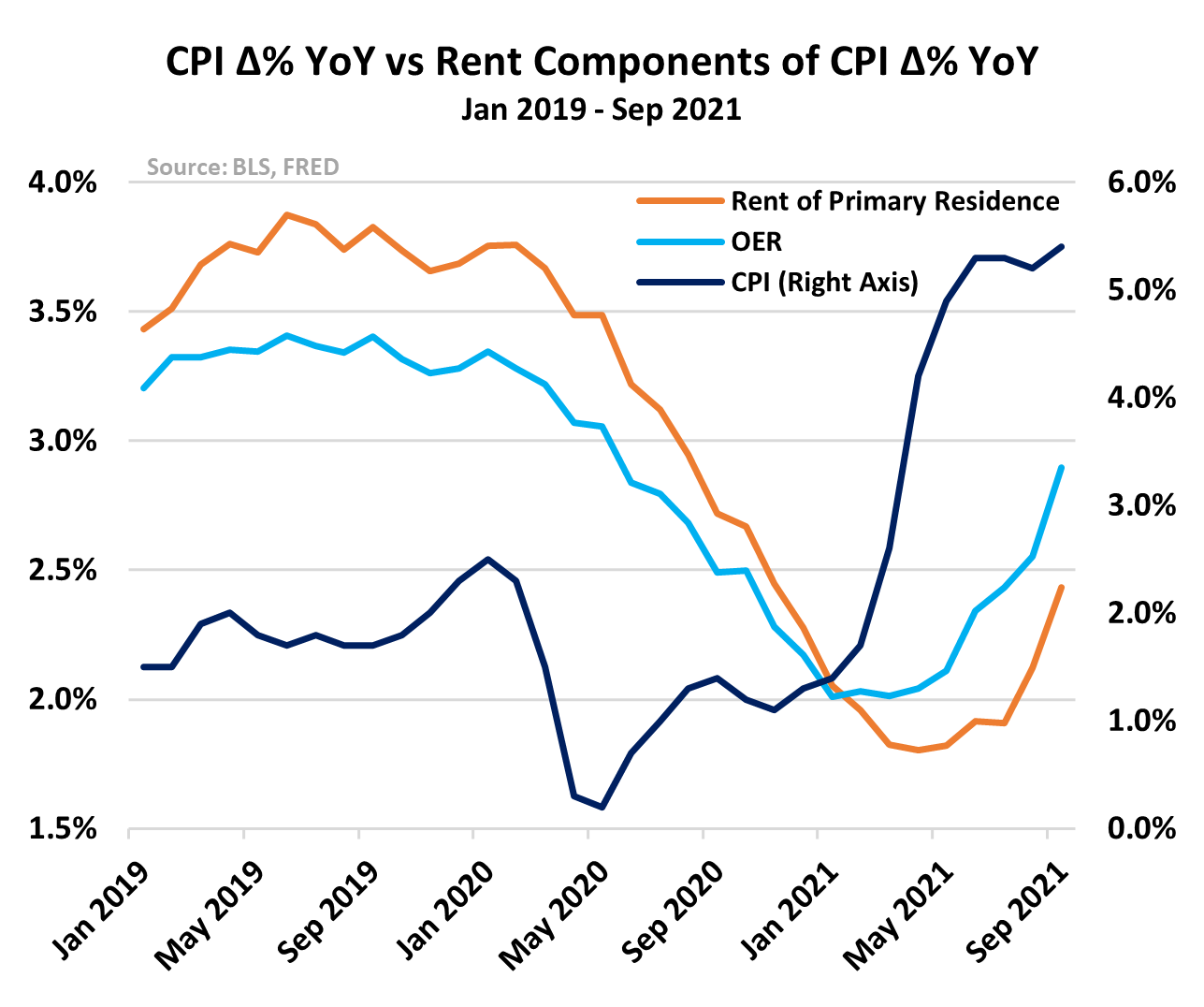

A continuing issue with US inflation data continues to be the way current inflation measurements track the cost of housing. Rent prices of primary residences and owners’ equivalent rent (OER, the amount of rent that would have to be paid in order to substitute a currently owned house as a rental property), comprise 7.9% and 24.3% of the CPI’s components, respectively, yet the CPI program only collects rent data from each sampled unit every six months.

Despite a relatively sharp upturn in reported rents in recent months, the overall growth of reported rent prices in the CPI actually remains well below pre-pandemic levels. Alternative sources of data show that government bureaus and agencies are significantly understating the actual rates of increase of rental prices. |

|

Realtor.com estimates that the median monthly rent in the US’s 50 largest metros was $1,654 in September, up 13.6% YoY, an increase of approximately $198, and marking the second consecutive month where national rent growth reached double digits. We believe higher rent payments are likely to continue keeping inflation higher than desirable.

At the same time, another key gauge of inflation is picking up. The employment cost index (ECI), a broad gauge of wages and benefits, rose at a record pace of 1.3% from the prior quarter and 3.7% YoY – a nearly 17-year high. Wages and salaries for civilian workers also rose at a record pace, surging 1.5% in the quarter.

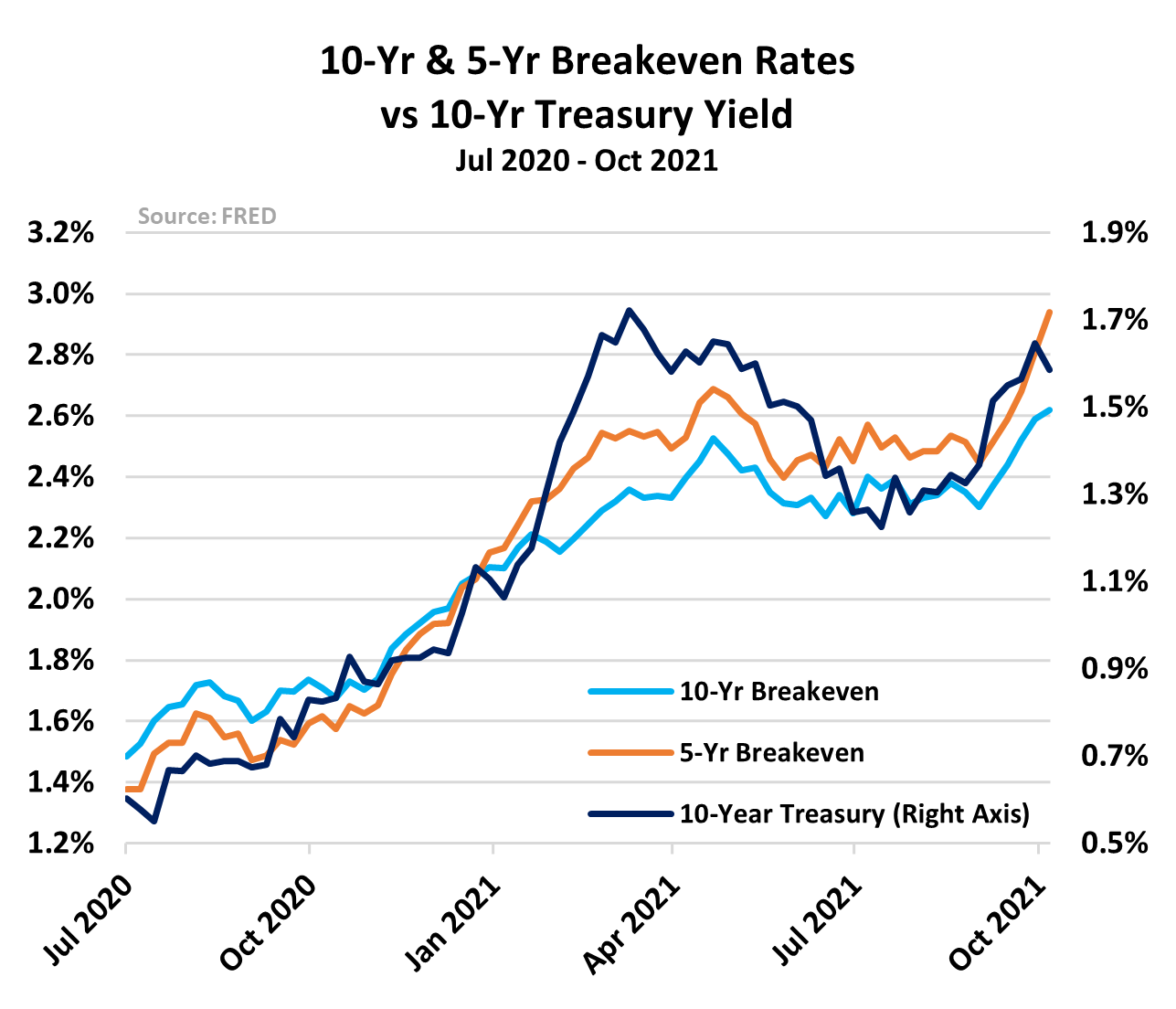

Breakeven rates of inflation provide a clearer picture of where inflation is headed. As the yield on the 10-year Treasury has moved above 1.5%, breakeven calculations for inflation expectations (the difference between the yield-to-maturity of a conventional Treasury coupon bond and that of a Treasury Inflation-Protected Security (TIPS) bond of the same maturity) have begun moving higher again, indicating that the bond market is pricing in sustained inflationary pressures in the months ahead. MRP has been pointing out the message being communicated by gradually rising breakeven rates since mid-2020.

At the start of 2021, the 10-year and 5-year breakeven rates each started the year at about 2%. Now, both have risen dramatically with the 5-year breakeven surging to almost 3% in recent weeks. In other words, bond traders now expect inflation to run at a rate almost 50% higher than the Fed’s target over the next 5 years. The expectation for the forward ten-year period is less at 2.6%, indicating that investors expect inflation pressures to be most intense over the next 5 years, then cool off in the second half of the decade ahead. |

|

At MRP, we think they have the direction right, but anticipate that even stronger price pressures may emerge. In last January’s Viewpoint, titled An Inflation Calculation we explained what could happen if the income velocity of money (total nominal GDP divided by a monetary aggregate) returned to pre-COVID levels over the next 5 years.

We posited that, if a return to late-2019 velocity took 10 years and nominal GDP growth averaged 5% annually, subtracting average real GDP growth over the last 30 years (approximately 2.3%) to estimate projected inflation would create the potential for price growth averaging 2.7% over the next decade. A 5-year recovery in velocity, therefore, would suggest inflation reaching levels in the mid to high single digits.

At that time, 5% inflation would have seemed like a crisis. Now, 5 consecutive months of 5.0% inflation has flown by – and we are still expected to call it “transitory”. What’s more, Federal Reserve data shows M1 and M2 velocity have not even begun to bounce back yet.

Charting an Uncertain Future at the Fed

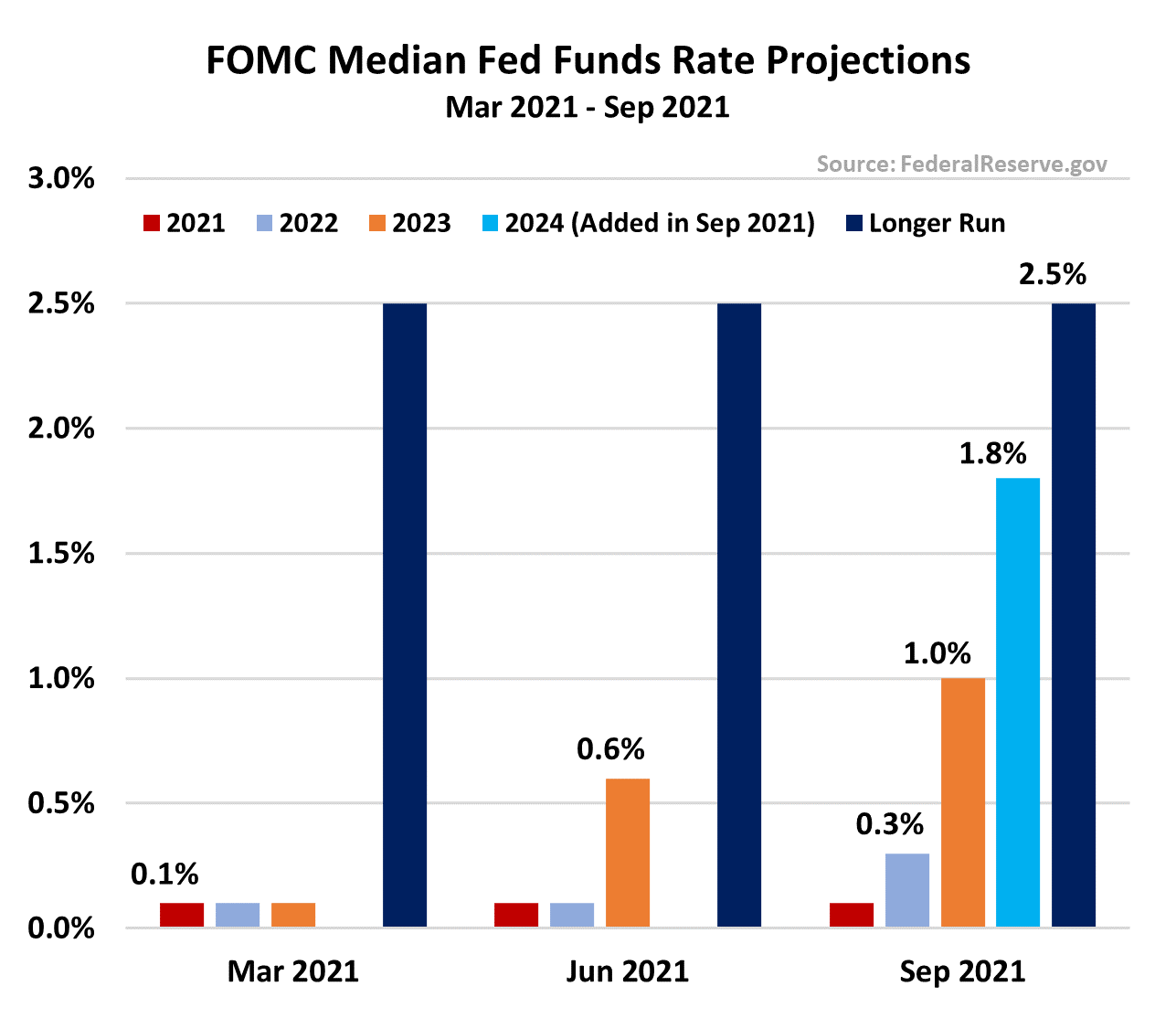

As we’ve already mentioned, the Fed will initiate some degree of monetary tightening in the form of tapering this month. They’ve also projected a rate hike at some point in 2022. By 2023 and 2024, they now expect the Fed Funds rate to climb to 1.0% and 1.8%, respectively. Assuming the Fed sticks to a schedule of 25bps increases, it would take 7 hikes to get an effective rate of 1.8% within range. |

|

Considering there are 26 monthly FOMC meetings between now and the end of 2024, this projected pace seems relatively conservative. However, a more aggressive pace is not out of the question, depending on how the recovery develops. But there is one major factor that could change that: Jerome Powell’s potential unseating as Fed Chairman.

Though it is remains likely that President Biden will renominate Powell, progressive Democrats in Congress have begun a sudden blitz to oppose the incumbent’s reinstatement. It began last month when Senator Elizabeth Warren (D-MA) went on the offensive against Powell during his testimony to the Senate banking committee: “Your record gives me grave concern… You have acted to make our banking system less safe, and that makes you a dangerous man to head up the Fed.”

“Dangerous” may be an extreme way to describe Powell, who has been as moderate as a policymaker can be. For some Democrats, however, that may no longer be good enough. Several other members of Congress have now joined Warren in criticizing Powell’s Fed and called for replacement at the top.

The conclusion of Powell’s first term comes just as controversy has exploded onto the scene at the central bank. In just the last month, two Fed Presidents, Robert Kaplan of the Dallas Fed and Eric Rosengren of the Boston Fed, resigned amid scrutiny of their financial dealings. Neither of the pair actually broke any rules, nor is Powell responsible for monitoring Fed Presidents’ personal portfolios, but scrutiny by the media ratcheted up in October and gave Warren the platform she needed to lay blame at the Chairman’s feet. “He has consistently failed to serve as an effective financial regulator… Chair Powell has also failed as a leader”, the Senator stated.

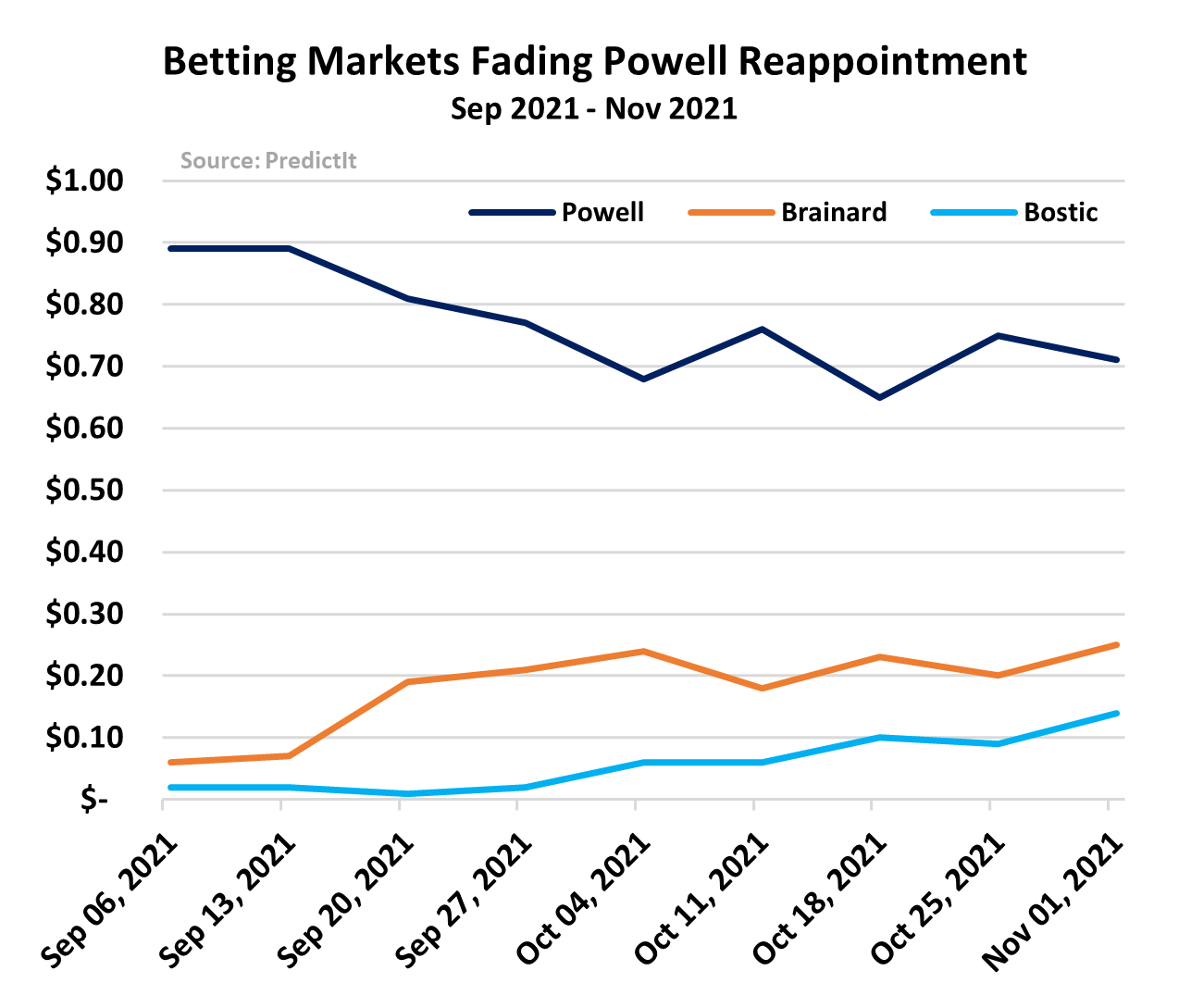

Those doubting Powell’s re-appointment are even starting to put their money on it. According to PredictIt.org, an online betting market that uses the price of a bet to gauge the most likely outcome of political events, gamblers think Powell’s chances at reappointment have begun to slip. In early September, a bet on Powell cost as much as $0.90 (the closer the price gets to $1.00, the more likely the outcome), but that price fell to a low of $0.70 this week. Meanwhile, a bet on Lael Brainard, a member of the Fed’s Board of Governors and a top contender to replace Powell, has jumped from $0.06 to $0.25. Atlanta Fed President Raphael Bostic has also seen his stock rise from just $0.01 to $0.14. |

|

Powell is still likely to retain his mandate, but the possibility of a new Chair is undoubtedly more of a concern than it was a few months back. Along with members of Congress, voices within Biden’s own administration have begun calling on him to make a change. Treasury Department nominee Graham Steele, for example, recently said it would be a “huge missed opportunity” not to replace Powell with a woman or member of a minority group to lead the central bank. The aforementioned Brainard and Bostic each fall into those categories.

For financial markets, the greater significance lies in the possibility that a more progressive Fed could begin to look beyond inflation and employment alone. It’s hard to imagine a more liberal central bank regime would want to rein in the money printer, especially if it’s focused on “eliminating climate risk and advancing racial and economic justice”, as Democrats including Reps. Alexandria Ocasio-Cortez (D-NY) and Rashida Tlaib (D-MI) have requested. US monetary policy has already resembled a real-world test of modern monetary theory (MMT) for the better part of two years, However, the formal implementation of that theory could become even more normalized with a reshaping of the Federal Reserve. MRP did a deep dive into MMT last year in our August 2020 Viewpoint, Money Matters: Inflation, MMT, and Other Stimulus Spin-Offs.

Q3 Weakened by COVID, But Growth Looks Set to Bounce Back

Earlier this year, MRP opined that the US could be headed toward a period of stagflation. A softening of macroeconomic data, observed throughout most of the third quarter, culminated in a Q3 annualized GDP reading of 2%, well below market forecasts of 2.7% and slowing sharply from 6.7% in Q2. September’s 5.4% CPI reading, a fourth consecutive month of CPI growth surpassing the 5.0% mark, suggests we were there already.

MRP believes there’s a good chance that the growth side of the equation will improve in the next couple of quarters as the third wave of COVID-19 continues to fade in the US. In fact, the Atlanta Fed’s GDPNow model now estimates Q4 growth could be as high as 8.2%. However, such a rebound will most likely contribute to more upside pressure on the general price level as well.

A Volkeresque, inflation-crushing monetary policy, rolled out over the next 5 years, may be the only policy that prevents the 2026-2031 period from be plagued by much stronger price pressure than current inflation projections would indicate. The Fed’s 5-Year, 5-Year Forward Inflation Expectation Rate, for instance, continues to project inflation just slightly above the 2.0% level, signaling that the ripple effect of massive money printing that’s happened throughout the last year will simply be absorbed by the economy, and data will eventually return to the “old normal”.

Is a dramatically hawkish shift in policy likely even if Jerome Powell is reappointed? We doubt it. Not so long ago, comparisons were being made with the 1920s; a period of tame inflation and solid growth. Most pundits who reference the “roaring ‘20s” are talking about real GDP. We think that it is the general price level that will be emanating the loudest roar in the 2020s.

|

|

|

|

Joseph J. McAlinden, CFA, is the founder of McAlinden Research Partners (MRP) and its parent company, Catalpa Capital Advisors. He has 50 years of investment experience. Mr. McAlinden founded Catalpa Capital in March 2007 after leaving Morgan Stanley Investment Management where he had spent 12 years, serving first as chief investment officer and later as chief global strategist. During his 10 year tenure as chief investment officer, he was responsible for directing MSIM’s daily investment activities and oversaw more than $400 billion in assets. As chief global strategist, he developed and articulated the firm’s investment policy and outlook. Prior to Morgan Stanley, Mr. McAlinden held positions as chief investment officer at Dillon Read and as President & CEO of Argus Research. |

|

|

|

|

|

|

|

|

|

|

|

ABOUT THE DIBS AND MCALINDEN RESEARCH PARTNERS

McAlinden Research Partners (MRP) publishes daily and other periodic reports on the economy and the markets.

MRP focuses on identifying change in the global economy and offering an investment thesis whenever an opportunity arises that has not yet been recognized by the market. The DIBs are MRP's compilation of articles and data from multiple sources on subjects reflecting change that have potential investment implications for an industry or group of securities. We share these with our clients who may already have or may be considering exposure in the industries affected. The subjects change daily and constitute an excellent update on featured topics. |

|

|

The information provided in this Report is not to be reproduced or distributed to any other persons. This report has been prepared solely for informational purposes and is not an offer to buy/sell/endorse or a solicitation of an offer to buy/sell/endorse Interests or any other security or instrument or to participate in any trading or investment strategy. No representation or warranty (express or implied) is made or can be given with respect to the sequence, accuracy, completeness, or timeliness of the information in this Report. Unless otherwise noted, all information is sourced from public data.

McAlinden Research Partners is a division of Catalpa Capital Advisors, LLC (CCA), a Registered Investment Advisor. References to specific securities, asset classes and financial markets discussed herein are for illustrative purposes only and should not be interpreted as recommendations to purchase or sell such securities. CCA, MRP, employees and direct affiliates of the firm may or may not own any of the securities mentioned in the report at the time of publication. |

|

|

|

|

|

|

|

|