To enter MRP's research library, click here. |

|

|

|

|

|

|

Friday, February 23, 2024 |

|

|

Welcome to MRP's Weekly Crypto Wrap, a look back at news reports, on-chain metrics, and other data that moved digital asset markets over the past week. These reports will be delivered every Friday morning, provided free of charge by MRP, and packed with useful information for those just beginning their research into Bitcoin and other cryptocurrencies, as well as investors with more experience in digital asset markets.

Click here to see everything we covered in the last iteration of the newsletter. |

|

|

|

|

THEMATIC SIGNALS

Aggregation of key events and breaking stories monitored by MRP |

|

|

BTC: Bitcoin Liquidity Shifts to the US as Spot ETFs Reshape Crypto Markets |

ETH: S&P Global Just Made Ethereum's Centralization Risk a TradFi Concern |

DeFi: MetaMask monthly active users nears all-time high — over 30 million |

Corporate Treasury: Reddit IPO filing reveals treasury exposure to Bitcoin, Ethereum |

Fintech: Jack Dorsey’s Block saw total customer sales of $2.52 billion worth of bitcoin in Q4, up 37% YoY |

|

|

|

|

ON-CHAIN & MARKET ANALYTICS

Breaking down the most critical trends and transaction patterns on the blockchain |

|

|

Digital asset prices were mostly steady throughout the past week, as the largest cryptocurrency by market cap, Bitcoin (BTC), was trading near $51,000 per unit on Friday morning. This was just about -1.5% lower than during the same time a week ago. Still, a near 20.0% gain throughout February has put BTC on track for a sixth consecutive monthly gain, a level of consistency that has not been achieved since early 2021. In fact, it would be tied for the longest ever string of green months in Bitcoin’s history, going back to 2011.

This near-record run might suggest BTC prices are due for a pullback after half a year of nonstop momentum, but the on-chain data continues to flash some of the hallmarks of a sustained bull market. First, the balance of Bitcoin held on more than 30 exchanges tracked by Glassnode appears to be making another leg down, slipping to an almost six-year low on February 22 at 2.314 million BTC (equivalent to about $118.0 billion). As a percentage of Bitcoin's total circulating supply, that sum represents just under 11.8%, the lowest share held on exchanges since December 2017. Though 2.9 million new BTC have been mined between then and now, roughly 85.0% of it has accrued to privately-held wallets owned by institutions or individuals. When supplies are held off-exchange, they less likely to be sold into the market.

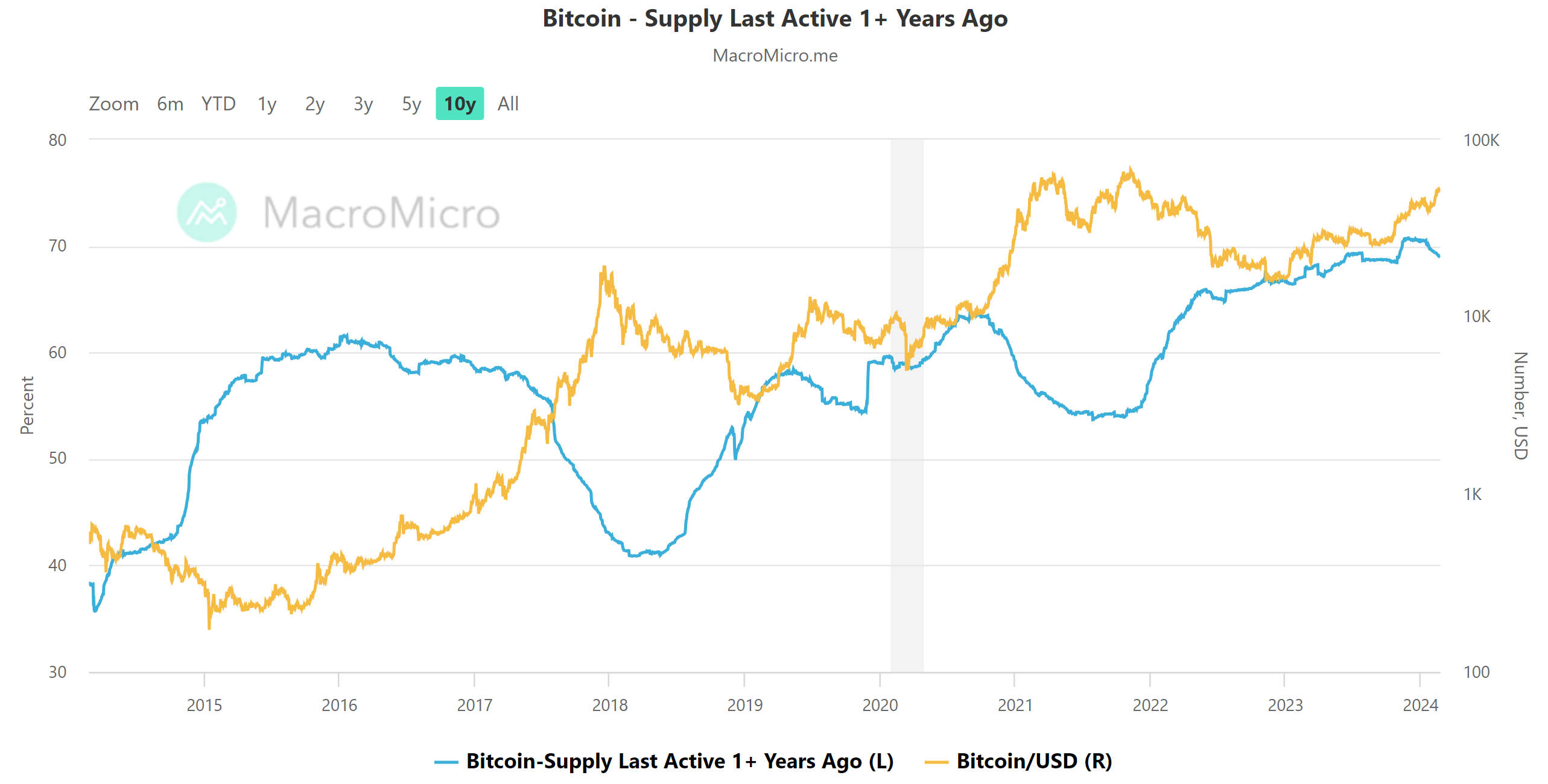

That split helps us understand how a record 70.8% of all Bitcoin had remained untransacted for at least a year by last November. After each boom in the price of Bitcoin, a so-called "bust" period tends to take place sequentially. During the bust, when the price of Bitcoin declines, long-term adopters continue to accumulate scarce BTC while traders sell. Traders or anyone else seeking to make short-term gains tend to make up a minority of Bitcoin investors. Each boom in demand mints a new class of long-term adopters and the bust allows this increasingly large cohort to accumulate more than they could have during the boom due to suppressed prices. When prices begin rising again, usually induced by shifting economic conditions and monetary policy decisions that tend to drive assets toward commodity assets like gold and Bitcoin, the most aggressive portion of a boom can often be confirmed by a material decline in the supply of BTC left untransacted for a year or more. If a Bitcoin remains in place and is not transferred to any other address, that means it is not being sent to an exchange for selling. |

|

Chart provided by MacroMicro.me |

Between September 2020 and November 2021, for instance, Bitcoin’s unit price surged from around $10,300 to an all-time high of nearly $69,000. Throughout that same period, the portion of BTC’s supply that had been idle for a year or more slumped from 63.5% to 54.5%. This decline signals a shift from accumulation to distribution among long-term adopters, as the appreciation of Bitcoin prices has become so rapid (a function of demand heavily outweighing available supply) that it can even shake loose some of the coins held so tightly by the most faithful long-term adopters who now want to take some profit by selling to new entrants drawn by speculation. Historically, the BTC accumulation that takes place when prices are subdued results in a smaller share of supply available on the market for the latest new entrants, compared to what was available at the beginning of the previous boom period, helping prices eventually push toward new all-time highs.

Back in March 2023, MRP noted that we were yet to see this cycle-defining feature appear in the on-chain data, suggesting a full-on bull market in Bitcoin and crypto markets was yet to be confirmed or that it was in very early stages with supply remaining relatively illiquid. By late August, however, it appeared that the accumulation among long-term adopters was beginning to peak, coinciding with the launch of our LONG Bitcoin Theme. We closed that Theme on December 20, 2023 after the ProShares Bitcoin Strategy ETF (BITO) – which we utilized to track the performance of the theme – returned 53%, vastly outperforming a 4% gain in the S&P 500 over the same span of time.

Since the start of the new year, MacroMicro data shows the share of BTC supply held in place for at least a year has declined from 70.6% to 68.9%, the largest decline witnessed since 2021. With Bitcoin still more than -26.0% below its all-time high, this shift in Bitcoin’s supply could suggest that the most aggressive portion of the boom period still lies ahead. |

|

|

|

|

DIGITAL ASSET DIBs MRP's latest Daily Intelligence Briefings on everything from BTC to DeFi and NFTs |

|

|

February 12, 2024: Bitcoin Rebound Revives Miner Shares Ahead of Highly-Anticipated Halving, Hash Rate Touches All-Time High → |

|

|

January 17, 2024: New BTC Funds See Strong Net Flows in First Few Trading Days, Interest May Shift to Potential ETH ETFs → |

|

|

January 9, 2024: Bitcoin ETF Decision on Deck as Optimism Builds, Level of Inflows Could Steer Crypto’s Course Ahead → |

|

|

December 4, 2023: Gold and Bitcoin Break Out, Greenback Stagnant on Rising Expectations for Earlier Rate Cuts → |

|

|

October 24, 2023: BlackRock Reaches Breakthrough Milestones in Bid to Launch Spot-Backed Bitcoin ETF → |

|

|

October 16, 2023: Bitcoin Now Worth More Than Half of Crypto Market Cap, ETF Prospects Keep Majority of Supply Unspent → |

|

|

|

|

THEMATIC SIGNALS: SUMMARIES |

|

|

BTC Bitcoin Liquidity Shifts to the US as Spot ETFs Reshape Crypto Markets

US trading venues on average accounted for almost half of bids and asks within 2% of Bitcoin’s mid-price so far this year, a period that straddles the launch of the US spot ETFs, data from research company Kaiko show. The impact of the ETFs is already visible. For instance, 57% of Bitcoin trading against the greenback is in US market hours now compared with 48% a year ago, according to Kaiko Senior Analyst Dessislava Aubert.

Read the full article from Bloomberg + |

|

|

|

|

ETH S&P Global Just Made Ethereum's Centralization Risk a TradFi Concern

S&P Global warned about the concentration risk present in Ethereum as Ether rallied in anticipation of a possible Ether ETF. Lido, the largest Ethereum validator with just under 33% stake, and Coinbase, holding 15%, pose potential concentration risks, but a potential ether staking ETFs in the U.S., along-side spot ETFs, may reduce this by opting for institutional custodians and diversifying stakes across multiple entities, S&P analysts wrote in their report.

Read the full article from CoinDesk + |

|

|

|

|

DeFi MetaMask monthly active users nears all-time high — over 30 million

Crypto wallet MetaMask reported the number of monthly active users has climbed 55% in four months — jumping from 19 million in September to more than 30 million in January. MetaMask allows users to self-custody and transact their crypto through a browser extension and a mobile app.

“We define a monthly active user as someone who either loads a page within the MetaMask extension or opens the mobile app at least once during any rolling 30-day period. These moments, the 2022 bull market peak and today’s figures, represent the two all-time highs for MetaMask.”

Read the full article from Blockworks + |

|

|

|

|

Corporate Treasury Reddit IPO filing reveals treasury exposure to Bitcoin, Ethereum

Social media giant Reddit has been quietly buying Bitcoin and Ethereum with some of its excess cash and holds an undisclosed amount of the two tokens in its treasury for investment purposes. Its new IPO filing clarifies that Reddit’s crypto holdings are confined to Bitcoin and Ethereum.

Reddit’s filing hinted at broader ambitions to integrate blockchain technology into its expansive network of forums and discussions. It described the platform’s ongoing efforts to diversify its revenue streams and enhance its digital infrastructure, with cryptocurrencies playing a crucial role in this strategy.

Read the full article from CryptoSlate +

|

|

|

|

|

Fintech Jack Dorsey’s Block saw total customer sales of $2.52 billion worth of bitcoin in Q4, up 37% YoY

Block recorded $2.52 billion in the total bitcoin sales amount to customers in the fourth quarter of 2023. The earnings report showed that the company gained $207 million in remeasured bitcoin holdings. Block held around 8,038 BTC at the end of last year, which was worth around $340 million at the time. In the fourth quarter of last year, the company’s mobile payment platform Cash App profited $66 million by selling BTC, according to the report. This bitcoin gross profit marks a 90% growth YoY.

Read the full article from The Block +

|

|

|

|

|

|

|

|

|

|

|

|

ABOUT THE DIBS AND MCALINDEN RESEARCH PARTNERS

McAlinden Research Partners (MRP) publishes daily and other periodic reports on the economy and the markets.

MRP focuses on identifying change in the global economy and offering an investment thesis whenever an opportunity arises that has not yet been recognized by the market. The DIBs are MRP's compilation of articles and data from multiple sources on subjects reflecting change that have potential investment implications for an industry or group of securities. We share these with our clients who may already have or may be considering exposure in the industries affected. The subjects change daily and constitute an excellent update on featured topics. |

|

|

The information provided in this Report is not to be reproduced or distributed to any other persons. This report has been prepared solely for informational purposes and is not an offer to buy/sell/endorse or a solicitation of an offer to buy/sell/endorse Interests or any other security or instrument or to participate in any trading or investment strategy. No representation or warranty (express or implied) is made or can be given with respect to the sequence, accuracy, completeness, or timeliness of the information in this Report. Unless otherwise noted, all information is sourced from public data.

McAlinden Research Partners is a division of Catalpa Capital Advisors, LLC (CCA), a Registered Investment Advisor. References to specific securities, asset classes and financial markets discussed herein are for illustrative purposes only and should not be interpreted as recommendations to purchase or sell such securities. CCA, MRP, employees and direct affiliates of the firm may or may not own any of the securities mentioned in the report at the time of publication. |

|

|

|

|

|

|

|

|