To enter MRP's research library, click here. |

|

|

|

|

|

|

|

|

Welcome to MRP's Weekly Crypto Wrap, a look back at news reports, on-chain metrics, and other data that moved digital asset markets over the past week. These reports will be delivered every Friday morning, provided free of charge by MRP, and packed with useful information for those just beginning their research into Bitcoin and other cryptocurrencies, as well as investors with more experience in digital asset markets.

Click here to see everything we covered in the last iteration of the newsletter. |

|

|

|

|

THEMATIC SIGNALS

Aggregation of key events and breaking stories monitored by MRP |

|

|

ETPs: Bank of America’s Merrill, Wells Fargo Offer Bitcoin ETF Products for Clients |

Derivatives: Euro-denominated Bitcoin futures will bolster institutional adoption — CME director |

Sovereign: El Salvador and pro-Bitcoin businesses reaping rewards after years of skepticism |

Miners: Bitcoin halving will benefit publicly listed miners: JPMorgan |

Exchanges: Crypto Exchange Gemini to Return $1.1 Billion to Customers in Regulator Settlement |

|

|

|

|

ON-CHAIN & MARKET ANALYTICS

Breaking down the most critical trends and transaction patterns on the blockchain |

|

|

A massive week for digital assets swung the cumulative market capitalization of all cryptocurrencies from under $2.0 trillion at last week’s close to a more than two-year high above $2.34 trillion by Thursday. That surge helped the unit price of the largest cryptocurrency, Bitcoin (BTC), jump out to $64,000 for a short time on Wednesday. This latest move is rivaled only by Bitcoin’s run to an all-time peak of nearly $69,000 in November 2021. Momentum was derailed by a Coinbase outage, however, which played a role in sending BTC back to $62,000 by Friday morning. Coinbase is the leading US cryptocurrency exchange and, per CEO Brian Armstrong, traffic on the platform exceeded the 10x spike they had modeled for and load tested.

A 44% gain throughout February made it the best month for BTC since November 2020 and marked a sixth consecutive monthly gain. This level of consistency has not been achieved since early 2021 and is tied for the longest ever string of green months in Bitcoin’s history, going back to 2011. In USD terms, February’s appreciation of more than $19,800 per BTC was the strongest monthly increase in Bitcoin history. Though this record run might suggest BTC prices are due for a pullback after half a year of nonstop momentum, MRP noted last week that the on-chain data has continued to flash some of the hallmarks of a sustained bull market. In particular, we highlighted the tendency for accumulation and distribution periods among long-term adopters to run inverse to the boom and bust nature of Bitcoin’s price action.

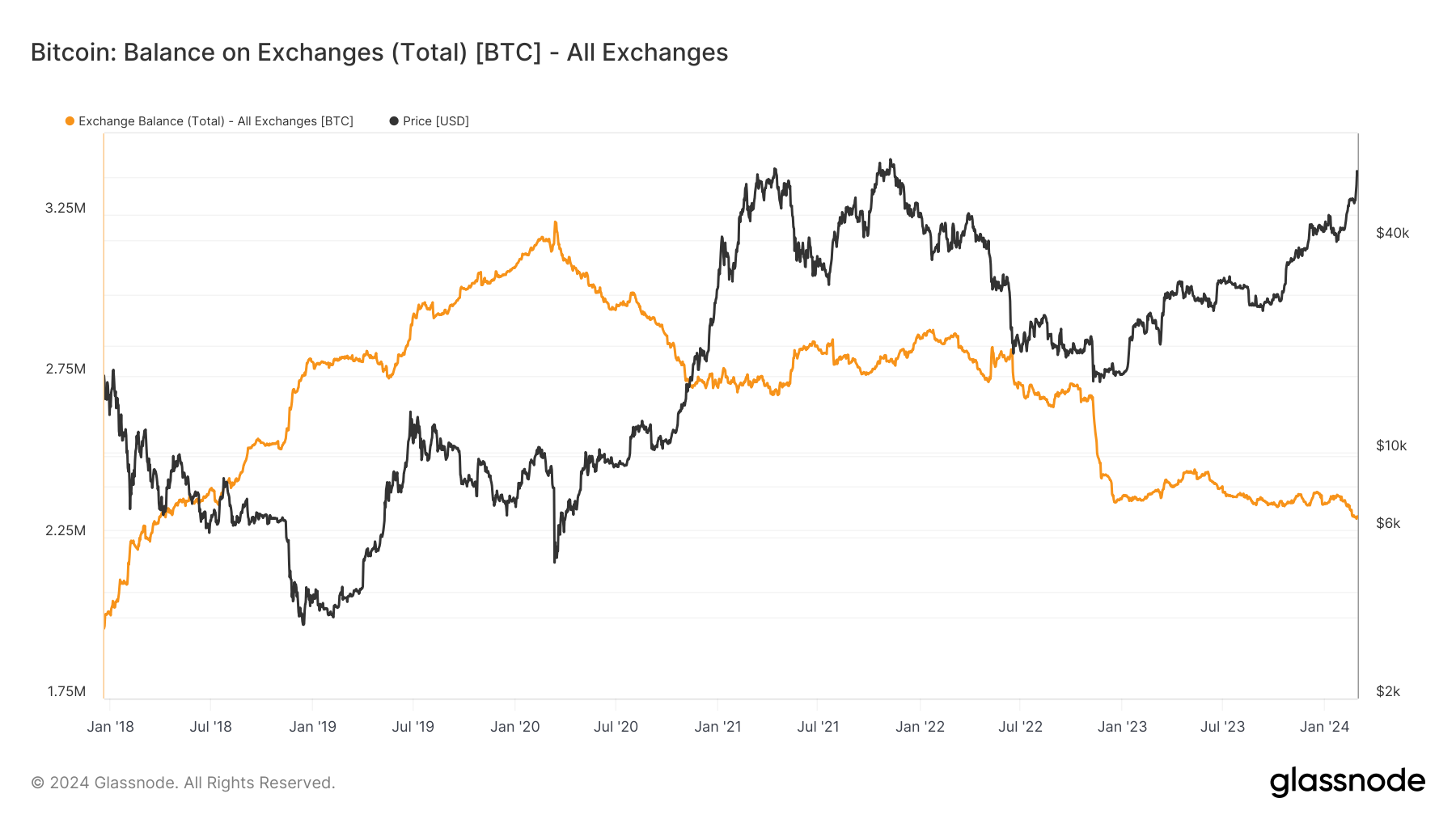

Additionally, price continues to appreciate while the balance of Bitcoin held on exchanges has been spiraling lower for years. MRP noted last week that the balance of Bitcoin held on more than 30 exchanges tracked by Glassnode appeared to be making another leg down, slipping to an almost six-year low on February 22 at 2.314 million BTC – but that figure had slumped even lower by February 27. Less than 11.8% of BTC’s circulating supply is now held on exchanges, the lowest share since December 2017. Earlier this morning, during Asia trading hours, CryptoSlate noted that approximately 16,000 BTC ($992 million) was withdrawn from Coinbase in one of the largest withdrawals from the exchange in history. |

|

Chart provided by Glassnode |

Net inflows to exchanges would be significant, as they’d indicate prices have risen to such a level where most investors are preparing to sell their BTC. By contrast, declining exchange balances typically indicate greater demand for digital assets among long-term adopters of the asset who plan to self-custody their digital assets over the long-term in a privately-held wallet device or other form of personal storage solution.

One differentiating factor in this cycle that was not present in past Bitcoin bull markets is the existence of spot ETFs. Though the initial launch of the ETFs turned out to be a "sell the news" event, as MRP predicted would likely be the case, increasingly aggressive inflows to these funds show that demand for BTC among a more traditional class of investors is beginning to take off. This morning, BlackRock’s iShares Bitcoin Trust (IBIT) became the fastest ever ETF to reach $10 billion in AUM. Only 152 of around 3,400 listed ETFs (under 5.0%) have surpassed this threshold.

Between February 26 – 29, the ten sponsors of spot-backed Bitcoin ETFs acquired a net 32,417 BTC ($2.0 billion) on behalf of their customers, while only 3,600 new BTC were mined throughout that time – equivalent to 900 BTC per day. New supply will be further constrained by the halving in April, when the amount of Bitcoin mined per block will be cut in half. This hardcoded change to Bitcoin’s distribution schedule occurs once every 210,000 blocks (roughly four years’ time) and will reduce daily issuance to just 450 BTC. |

|

|

|

|

DIGITAL ASSET DIBs MRP's latest Daily Intelligence Briefings on everything from BTC to DeFi and NFTs |

|

|

February 12, 2024: Bitcoin Rebound Revives Miner Shares Ahead of Highly-Anticipated Halving, Hash Rate Touches All-Time High → |

|

|

January 17, 2024: New BTC Funds See Strong Net Flows in First Few Trading Days, Interest May Shift to Potential ETH ETFs → |

|

|

January 9, 2024: Bitcoin ETF Decision on Deck as Optimism Builds, Level of Inflows Could Steer Crypto’s Course Ahead → |

|

|

December 4, 2023: Gold and Bitcoin Break Out, Greenback Stagnant on Rising Expectations for Earlier Rate Cuts → |

|

|

October 24, 2023: BlackRock Reaches Breakthrough Milestones in Bid to Launch Spot-Backed Bitcoin ETF → |

|

|

October 16, 2023: Bitcoin Now Worth More Than Half of Crypto Market Cap, ETF Prospects Keep Majority of Supply Unspent → |

|

|

|

|

THEMATIC SIGNALS: SUMMARIES |

|

|

ETPs Bank of America’s Merrill, Wells Fargo Offer Bitcoin ETF Products for Clients

Bank of America Corp.’s Merrill arm and Wells Fargo & Co.’s brokerage unit are offering spot-backed Bitcoin ETFs to some wealth management clients with brokerage accounts who request the products. Bank of America’s Merrill and Wells Fargo join Charles Schwab Corp. and Robinhood Markets Inc., which started offering the spot Bitcoin ETFs shortly after their approval. Morgan Stanley is evaluating adding the funds to its platform.

Read the full article from Bloomberg + |

|

|

|

|

Derivatives Euro-denominated Bitcoin futures will bolster institutional adoption — CME director

The upcoming launch of euro-denominated Bitcoin and Ether futures products could bolster institutional cryptocurrency adoption in the eurozone, Giovanni Vicioso, the executive director of equity and alternative products at the CME Group, told Cointelegraph in an exclusive interview. The CME has nearly doubled its average daily Bitcoin trading volume, from an average of $1.6 billion a day in 2023 to over $3 billion of daily trading volume in 2024, according to Vicioso.

Read the full article from Cointelegraph + |

|

|

|

|

Sovereign El Salvador and pro-Bitcoin businesses reaping rewards after years of skepticism

El Salvador, under the leadership of its innovative government, took a bold step by integrating Bitcoin into its national economy in 2021. President Nayib Bukele recently said that the country’s investment in Bitcoin, primarily acquired when the market was bearish, could now yield a profit exceeding 40%. Despite the potential for substantial gains, Bukele said the country has no plans to sell its holdings and views it as a permanent reserve.

Read the full article from CryptoSlate + |

|

|

|

|

Miners Bitcoin halving will benefit publicly listed miners: JPMorgan

JPMorgan analysts, led by Nikolaos Panigirtzoglou, believe that the bitcoin network could experience a 20% drop in hashrate post-halving, due to inefficient mining rigs going offline. JPMorgan predicts that the production cost range could drop to $42,000.

The analysts at JPMorgan added that publicly traded miners could be nicely positioned post-halving. Larger scale mining operations tend to have fixed agreements with power companies “which along with a more sustainable energy mix help them to lower electricity costs, a major component of the overall bitcoin production cost.”

Read the full article from Blockworks +

|

|

|

|

|

Exchanges Crypto Exchange Gemini to Return $1.1 Billion to Customers in Regulator Settlement

New York’s financial regulator said Gemini Trust has agreed to return at least $1.1 billion to users of the cryptocurrency exchange’s Earn investment program. Gemini’s Earn program allowed customers to loan their cryptocurrency to Genesis and earn interest payments in return. Gemini failed to oversee and vet its partner in the Earn program, now-bankrupt crypto lender Genesis Global Capital. Genesis defaulted in November 2022 on loans worth about $1 billion made by Earn customers, before filing for bankruptcy in January 2023.

Read the full article from The Wall Street Journal +

|

|

|

|

|

|

|

|

|

|

|

|

ABOUT THE DIBS AND MCALINDEN RESEARCH PARTNERS

McAlinden Research Partners (MRP) publishes daily and other periodic reports on the economy and the markets.

MRP focuses on identifying change in the global economy and offering an investment thesis whenever an opportunity arises that has not yet been recognized by the market. The DIBs are MRP's compilation of articles and data from multiple sources on subjects reflecting change that have potential investment implications for an industry or group of securities. We share these with our clients who may already have or may be considering exposure in the industries affected. The subjects change daily and constitute an excellent update on featured topics. |

|

|

The information provided in this Report is not to be reproduced or distributed to any other persons. This report has been prepared solely for informational purposes and is not an offer to buy/sell/endorse or a solicitation of an offer to buy/sell/endorse Interests or any other security or instrument or to participate in any trading or investment strategy. No representation or warranty (express or implied) is made or can be given with respect to the sequence, accuracy, completeness, or timeliness of the information in this Report. Unless otherwise noted, all information is sourced from public data.

McAlinden Research Partners is a division of Catalpa Capital Advisors, LLC (CCA), a Registered Investment Advisor. References to specific securities, asset classes and financial markets discussed herein are for illustrative purposes only and should not be interpreted as recommendations to purchase or sell such securities. CCA, MRP, employees and direct affiliates of the firm may or may not own any of the securities mentioned in the report at the time of publication. |

|

|

|

|

|

|

|

|