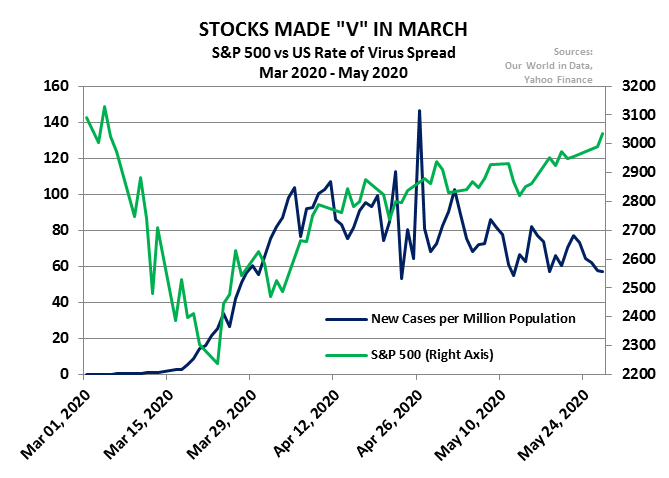

In the months since the COVID-19 crash began, stock prices have been on a wild ride in anticipation of a tsunami of poor economic data. However, some investors appear to be seeing the light at the end of the tunnel including MRP. While most see a V-shaped recovery as doubtful, we feel that the combination of what appears to be limitless fiscal and monetary stimulus, combined with better than expected re-opening data in a number of states, provides compelling reason to expect a V-shaped recovery.

A V or not a V; that is the question. At least for the moment. According to a majority of commentators, the answer is not a V. But MRP is in the distinct minority, still expecting a sharp economic rebound.

And now new questions have arisen, in particular, how permanently the aftereffects of the COVID-19 pandemic will affect long-term growth beyond the initial recovery whatever its shape. Many notable sources have described scenarios of substandard economic growth for years to come irrespective of the shape of the recovery in the short run. Given the vigorous rebound of stock prices globally, the answers to both questions have critical implications for investor decision-making. Bursting the Cable News Bubble

Bursting the Cable News Bubble

Even with the S&P 500 closing in on its pre-crash high, many have struggled to let their guard down. While that is understandable, given the slow re-opening of many facets of the US economy, the financial media, as always, has their own hands on the reigns of investor sentiment as well. In fact, one could argue that the media is wielding even more power these days amid quarantines, layoffs, and office closures that have driven up TV viewership. Per Comcast, the average American household is now watching at least 8 hours more per week. In early March 2020, the average household watched 57 hours of content per week. That’s now up to 66 hours a week. More to our point, the Comcast data shows an increase of up to 64% in consumption of news programming since the start of COVID-19.

A 2017 study out of New York University, estimating the size of the tilt in financial media coverage found that a greater amount of media coverage foreshadows declines in firms’ profitability and negative earnings surprises…

To read the rest of this Viewpoint, START A FREE TRIAL You’ll also gain access to: If you already have a subscription, sign in