In tandem with reaching the median terminal rate its policymakers laid out in March, the Federal Reserve boosted bets on a coming pause in their rate hike regime by making a somewhat dovish adjustment to the language of the FOMC’s most recent statement. As disinflation gradually takes hold in the US, European gauges of core inflation remain elevated near all-time highs. The size of the ECB’s most recent rate hike was halved from its prior meeting, but officials have been adamant that tightening will continue. This divergence carries significant implications for real rates in each of the central banks’ jurisdictions, which will flow downstream to the relationship between the Dollar and Euro. Rising real rates in the Eurozone could continue to threaten the Dollar, which has come down significantly from its 2022 peak, and strengthen the Euro.

Peak Hawkishness Turns to Dovish Shift

In our August 2022 Viewpoint, The FX Timebomb, MRP highlighted The Economist magazine’s resurrection of their Big Mac Index, an interactive currency comparison tool based on fluctuations in the price of the McDonald’s sandwich sharing the same name. At that time, The Economist’s calculations showed that the Euro (EUR) was -7.5% undervalued compared with the US Dollar (USD). That gap has narrowed significantly to -1.5% in the time since, coinciding with a broad downturn in the US Dollar Index (DXY). Since reaching a peak toward the end of September, the DXY has fallen from a 20-year high near 114.10 to roughly 102.00 in early May, a decline of -10.6%.

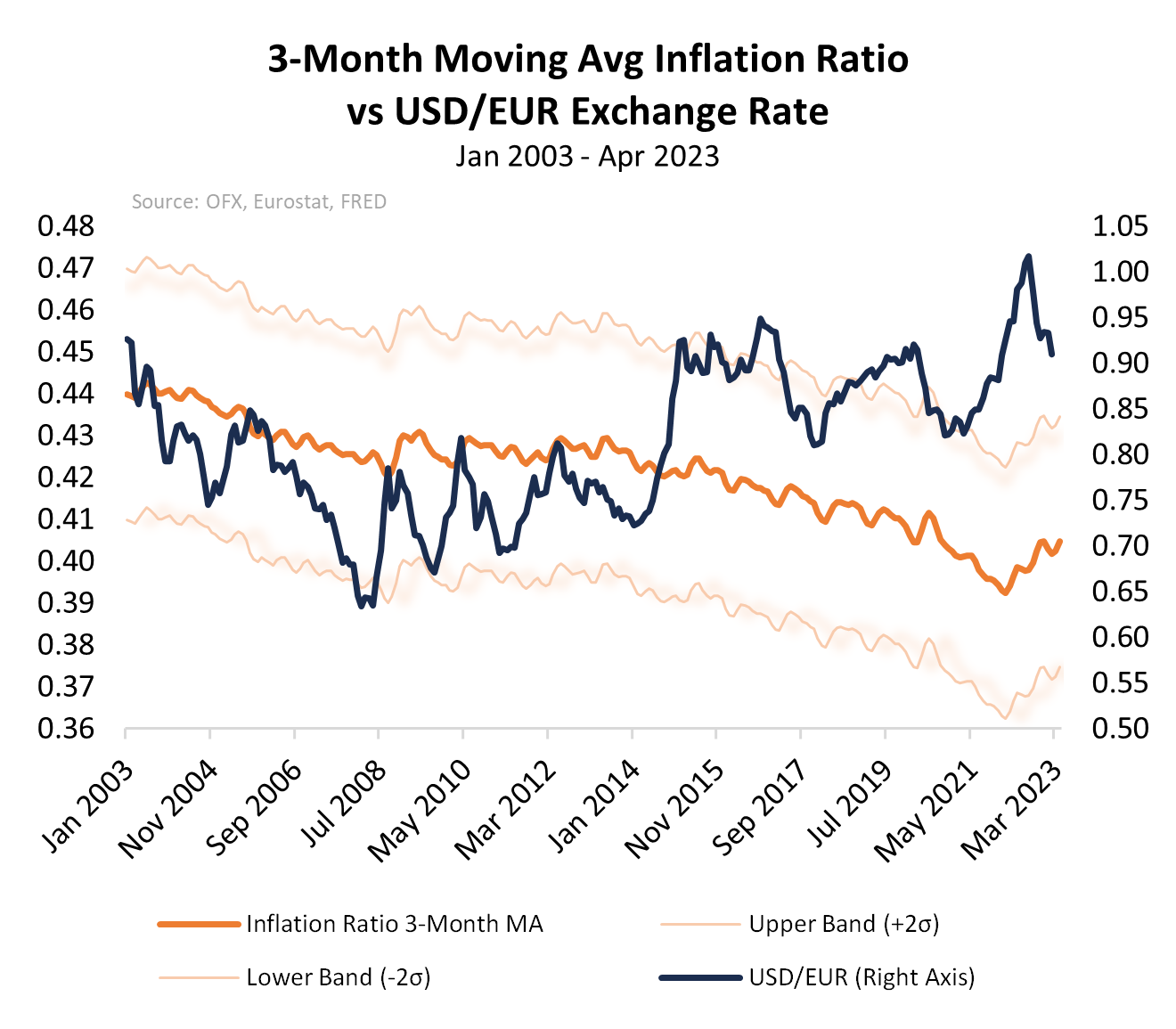

Over the very long run, exchange rates are primarily determined by the relative changes in the cost of living between countries. That is what economists call Purchasing Power Parity (PPP); it is the central tendency to which exchange rates eventually mean-revert. A simple PPP, using a ratio of the EU to US consumer price indexes (CPI), shows that moves in exchange rates often follow the relative trends in inflation. The Dollar broke away from this this inflation ratio by more than two standard deviations (which should encompass approximately 95% of observations) in the latter portion of 2022. Last August, we calculated USD to be as much as 31.0% overvalued versus EUR. Since then, USD/EUR has tumbled -7.2%, but could weaken a further -21.4% if the exchange rate were to continue gravitating toward the central tendency of the inflation ratio.

As MRP wrote in our aforementioned Viewpoint last August, the strong Dollar’s days were numbered and a rolling over was expected in the months ahead, based on our view that the US Federal Reserve had reached the point of “Peak Hawkishness”, the point at which rate hikes reached their maximum size and frequency. Essentially, we posited that, while the Fed would continue to increase their benchmark Fed Funds rate, these hikes would only shrink from the peak of 75bps reached last summer and, eventually, not be required at every subsequent FOMC meeting.

Meanwhile, the European Central Bank (ECB) was just beginning to ramp up their rate hiking regime. In turn, that divergence in policy expectations would reduce the real rate differential between the Eurozone and US and benefit the EUR in relation to USD.

Since last August, the ECB has raised their benchmark short-term rate by 275bps while the Fed has increased the upper limit of the Fed Funds rate by 250bps. That is not a huge differential, but there are several reasons to think this disparity will…

To read the complete Viewpoint, current MRP Pro and All-Access clients, SIGN IN MRP Pro clients receive access to MRP’s list of active themes, Joe Mac’s Market Viewpoint, and all items included as part of the MRP Basic membership. For a free trial of our services, or to save 50% on your first year by signing up now, CLICK HERE