After more than a year of fighting breakout inflation, the Fed appears to have finally gotten a firm grip on out-of-control price pressures, which now continue to soften month after month. The next challenge for monetary policymakers will be shifting policy toward a more neutral stance, avoiding the allure of getting stuck in a hawkish spiral. Just as the Fed stayed too dovish for too long in 2020-2021, they’ll need to avoid being baited into overtightening and creating an inverse spate of the economic turmoil we witnessed in the wake of the central bank’s disastrous “transitory” debacle.

Inflation Stumbling, But More Rate Hikes May Pile On

From the Fed that stayed too easy for too long, we are now told more restriction is necessary amidst what is already one of the most aggressive sprees of tightening in the Federal Reserve’s history. The supposed need for more rate hikes has arisen in spite of what the latest price data appears to show.

The Fed presumably has hundreds of economics PhDs looking at the data, yet it seems they do not see or will not publicly acknowledge that inflation appears to be heading back to preferred levels well-ahead of schedule. To outside observers, many at the central bank seem bent on continually increasing short-term rates until employment and GDP growth begin to change course dramatically, even though their most preeminent battle may have already been won.

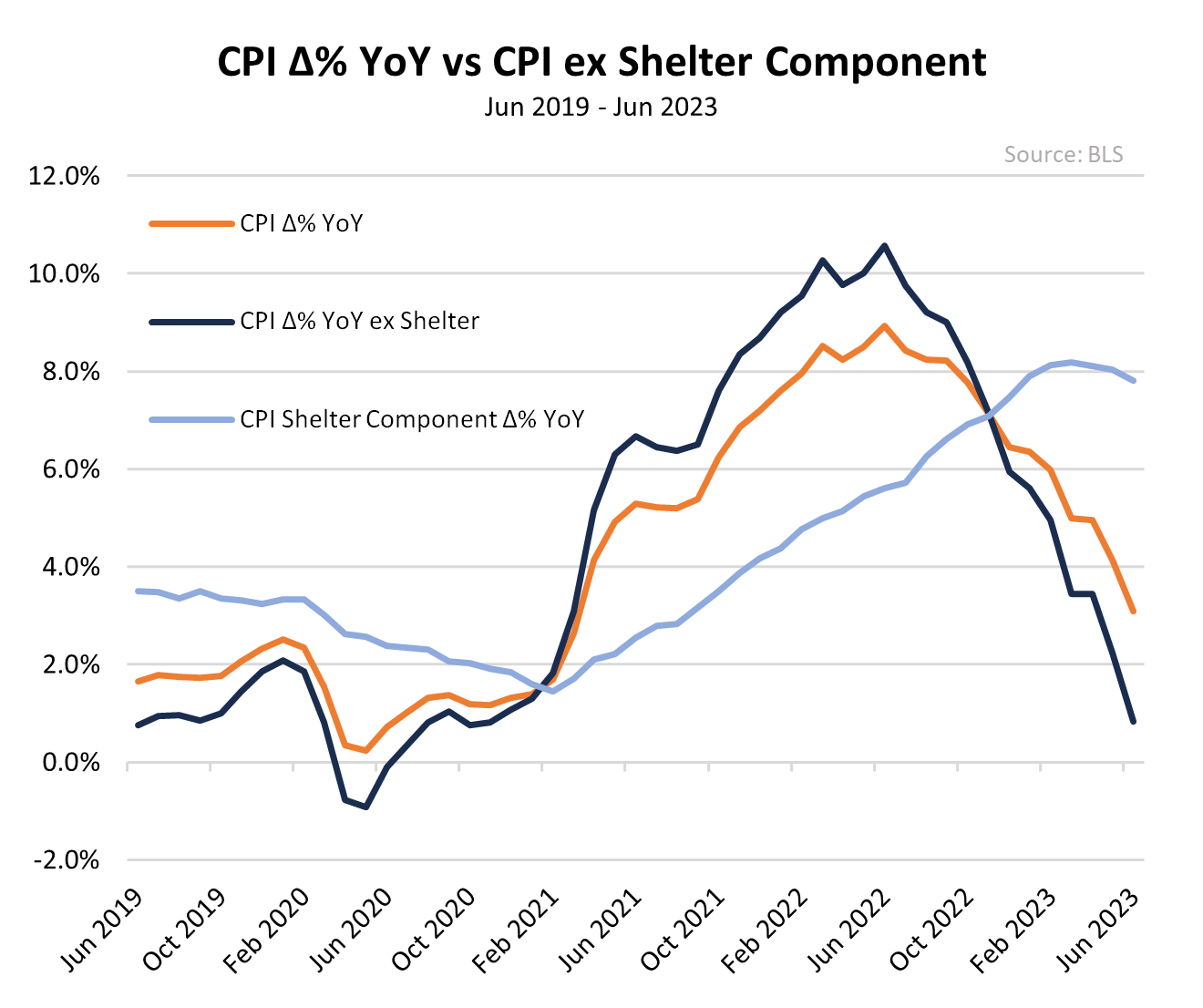

That fight has been the Fed’s struggle to wrangle inflationary pressures and bring it back toward its long-term target of 2.0%. If we look at the CPI, for instance, the index was just shy of a 9.0% YoY gain in June of 2022, but that figure was cut by almost two-thirds to just 3.1% in June of this year. Moreover, as MRP has previously noted, this headline number is distorted by the treatment of shelter costs (composed of rents of primary residences and the owners’ equivalent rent), which suffers from a massive lag, yet accounts for about a third of the headline index. When the shelter component is removed from the calculation, the CPI was increasing at a rate of less than 1.0% in the most recent month of data – more than achieving the Fed’s target for broader inflation. The latest private data on home prices collected by the S&P CoreLogic Case-Shiller Home Price Index has been falling on YoY basis for three straight months now, posting their largest declines in more than a decade in April in May. Meanwhile, the shelter component of the CPI has only recently peaked and is still advancing at an annual rate of 7.8%.

Relentless tightening with little regard for the amount of time it takes for higher rates to filter through the economy risks going further than necessary and having to aggressively flip the switch back toward looser policy to avert or minimize the impact of a recession – an outcome that has followed every bout of Fed easing since the turn of the millennium. Much like how the Fed refused to acknowledge that their money printing actions were sowing the seeds of the big inflation surge the US would experience, they may now be more dedicated to more tightening than the economy can handle…

To read the complete Viewpoint, current MRP Pro and All-Access clients, SIGN IN MRP Pro clients receive access to MRP’s list of active themes, Joe Mac’s Market Viewpoint, and all items included as part of the MRP Basic membership. For a free trial of our services, or to save 50% on your first year by signing up now, CLICK HERE