Despite a boom in deployments through 2020-2021, solar energy stocks have been whacked in recent months and could face more short-term downside as a result of rising metals costs and shortages of silicon in the module supply chain.

However, new technologies focused on increasing cost efficiency and replacing scarce polysilicon with perovskites could revolutionize the industry and begin to boost profitability over the next several years.

Related ETFs: Invesco Solar ETF (TAN), iShares Silver Trust (SLV), iPath Series B Bloomberg Copper Subindex Total Return ETN (JJC)

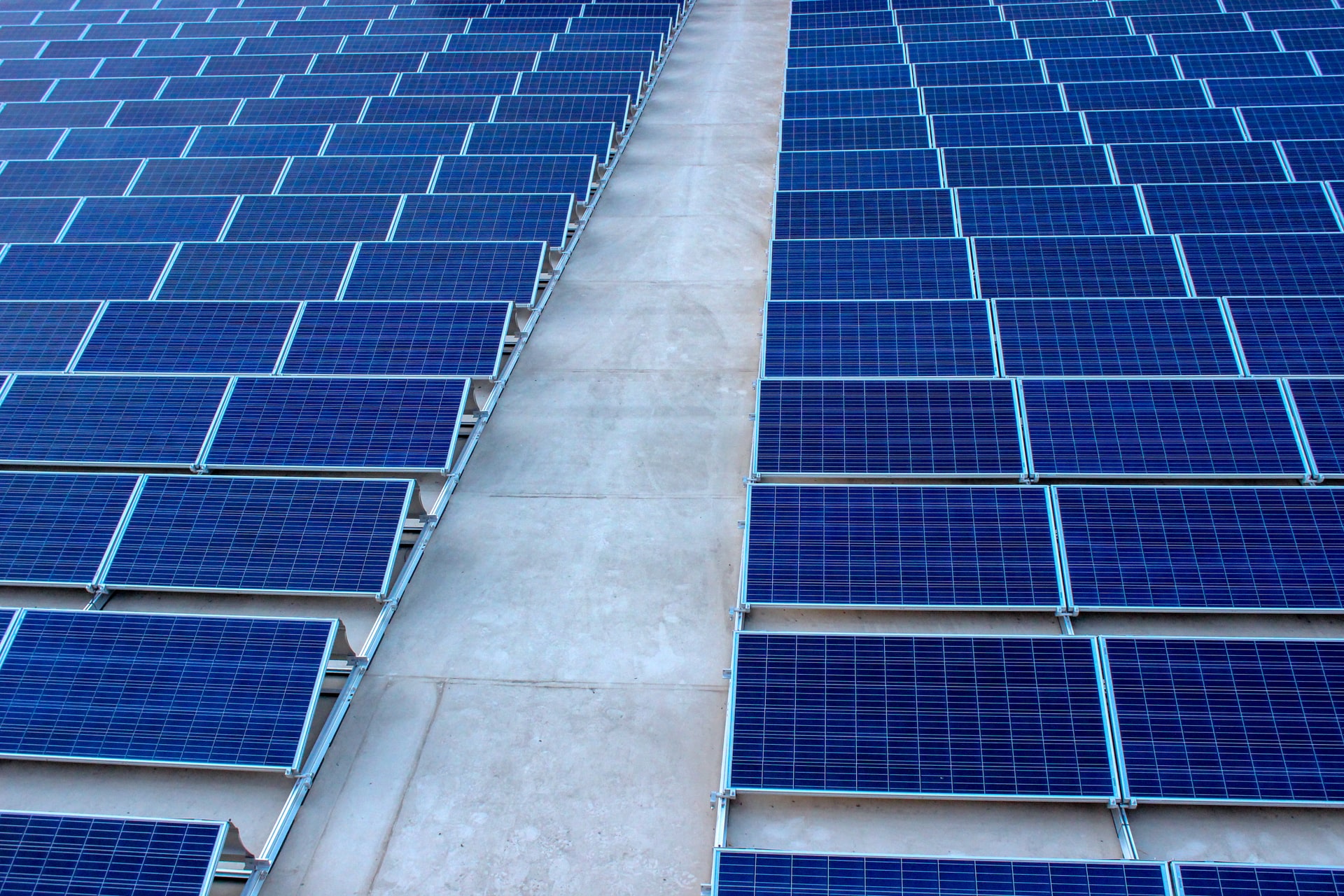

The world added more than 260 GW of renewable energy capacity last year, exceeding expansion in 2019 by close to 50%, despite the economic slowdown that resulted from the COVID-19 pandemic, according to data from the International Renewable Energy Agency (IRENA). Solar power led the growth, with 127 GW, representing nearly half of all new capacity.

In the US market, solar deployment reached a record 19.2 GW of capacity last year, a volume expected to quadruple by 2030, according to the US Solar Market Insight Report released by the Solar Energy Industries Association (SEIA) and Wood Mackenzie Power. Per UtilityDive, that new capacity means solar made up the majority of new electricity resource additions for 2nd year in a row.

According to Cleantechnica, 77–80% of new US power capacity came from solar and wind power in 2020. Data from the US Energy Information Administration (EIA) showed renewable energy accounted for 20.6% of overall US electricity generation last year.

As MRP noted back in November, the International Energy Agency (IEA) has already anointed solar power the “new king” of global electricity markets after becoming the cheapest form of electricity in history.

For utility-scale solar projects completed this year, the average cost of electricity generation over the lifetime of the plant (called the levelized cost of electricity) was between $35 to $55 per megawatt hour in some of the world’s biggest markets — the US, Europe, China, and India. The cost for coal, in comparison, currently ranges between about $55 and $150 per megawatt hour.

However, several headwinds – including material shortages and a need to scale up solar panels/modules’ efficiency – are becoming a more present threat to the industry’s profitability in the short-term. This represents a significant problem for an industry with notoriously extended valuations, now being whacked by rising bond yields and the threat of higher interest rates down the line.

Rising Polysilicon, Metals Costs Putting on Pressure

Like many other businesses across the global economy, the solar industry is currently dealing with rising costs and shortages of key materials.

As Saur Energy International recently wrote, polysilicon prices have increased another 10% compared to Q4 2020 despite their fabricators running at 100% capacity. According to JinkoSolar’s Dany Qian, the rising cost of polysilicon mean solar manufacturing material shortages are nearing a crisis point.

According to Nasdaq, polysilicon costs have flowed down the supply chain and caused photovoltaic (PV) module prices to increase by at least 20%.

While new polysilicon capacity is expected to come onstream later this year, PVTech.org writes that supply is widely expected to remain constrained for some time…

To read the rest of this Market Insight, START A FREE TRIAL You’ll also gain access to: If you already have a subscription, sign in