As we move toward the end of the third quarter, there are more and more green shoots starting to pop up in the macro data, accompanying a broader “re-opening” of the US economy. All of this renewed optimism, though, does not come without costs. This year’s unprecedented fiscal deficit and expansion of the monetary base, while thus far effective in kick starting a recovery, could threaten a big rebound in inflation in coming months and has prompted new discussions about new ways to approach government spending, particularly Modern Monetary Theory (MMT). The Fed, for its part, appears less concerned than usual about stemming upward price pressures with their latest dovish shift in policy, likely to prolong strong bull runs in stocks and bonds.

Amid the recovery from the COVID-crash, “The New Normal” has become one of the most popular expressions to describe the way that so much has changed in the span of just about 5 months.

It started with personal habits, things like wearing a mask and cutting down on handshakes, eventually evolving into the “working from home” revolution. Now, fiscal and monetary policy are facing major shifts that will have long-term effects on the economic landscape of the US.

Unprecedented Stimulus Measures

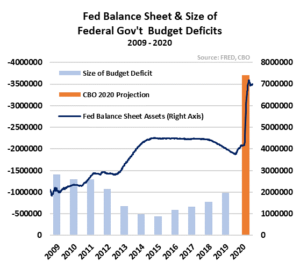

The Fed’s balance sheet has now ballooned to almost $7 trillion, a 67% increase year to date, just 12 months after the central bank ended their balance sheet shrinkage that had been in place since October 2018.

Total federal spending on New Deal programs, meant to counter the Great Depression, was $41.7 billion at the time, but adjusted for inflation, total spending was equivalent to $856.1 billion. The total adjusted cost of 2008 – 2009’s stimulus efforts from TARP and ARRA came in around $1.8 trillion.

By comparison, the Coronavirus Aid, Relief, and Economic Security Act (CARES Act), now the single most expensive piece of relief legislation in US, funded $2.2 trillion of new spending in the bill, worth about 10% of the United States’ yearly GDP. The St. Louis Fed estimates that the aforementioned relief packages from the financial crisis would have accounted for less than 6% of the country’s annual output.

Congress is currently working out even more stimulus worth anywhere from an additional $500 million to $2 trillion.

And that’s just the fiscal stimulus. Monetary stimulus has been even more vigorous in pursuing stability and liquidity in financial markets with the Fed buying everything from US bonds to ETFs tracking corporate debt by the boatload.

As of last weekend, Bloomberg data, cited by Zero Hedge, showed the Fed owned 22,913 different securities, making it the world’s largest investor.

The initial onus for the Fed to re-ignite securities purchases and initiate a new easing cycle even before COVID hit was persistently low inflation and a slowdown in growth last year, perceived symptoms of hiking short-term rates too quickly. This time last year, the target range of the Fed Funds rate was at a cycle peak of 2.25% – 2.50%. Easing settled in slowly at first, with the FOMC cutting rates by 75bps through the end of 2019, a reasonable approach that bolstered asset prices and begun feeding through to much more robust inflation data.

Once COVID slammed the US, rates were cut by 150bps in March alone, bringing the Fed Funds rate back to zero for the first time since 2015.

Inflation to Run Hotter?

As stimulus efforts paid off and green shoots in the economy have begun to emerge, particularly in places like the housing sector, expectations of higher prices have bloomed as well…

To read the rest of this Viewpoint, START A FREE TRIAL You’ll also gain access to: If you already have a subscription, sign in