Traditionally, multiples like price to earnings ratios (P/Es) run inverse to inflation data. That balance has been completely upended over the last year by unprecedented fiscal and monetary stimulus measures employed to combat the economic impact of COVID-19. Though a new wave of the pandemic threatens to delay the Fed’s plan to taper asset purchases by the end of Q3, policymakers will find it increasingly difficult to put off a tightening of policy if inflation remains elevated and long-term rates begin a resurgence. Until then, however, stocks may continue making new highs.

Equities continue to trade at historically high valuations. Per Dow Jones Market Data, the S&P 500 index recorded its 51st record high of the year last week – the most closing records to this point in a calendar year in more than two and half decades.

Today, the S&P 500 once again closed at a new all-time high above 4,535. With 97% of companies in the benchmark index reporting, S&P Indices estimates Q2 earnings per share (EPS) will total $158.74. According to those figures, the S&P 500 is trading at more than 28.5 times its trailing twelve months (TTM) earnings.

For context, that is higher than the P/E ratio of the market peak preceding 7 of the last 8 bear markets – the only exception being the dot com crash, which lasted from 2000 to 2003.

Many have begun to view extended valuations and multiples as some kind of new normal. But others are worried.

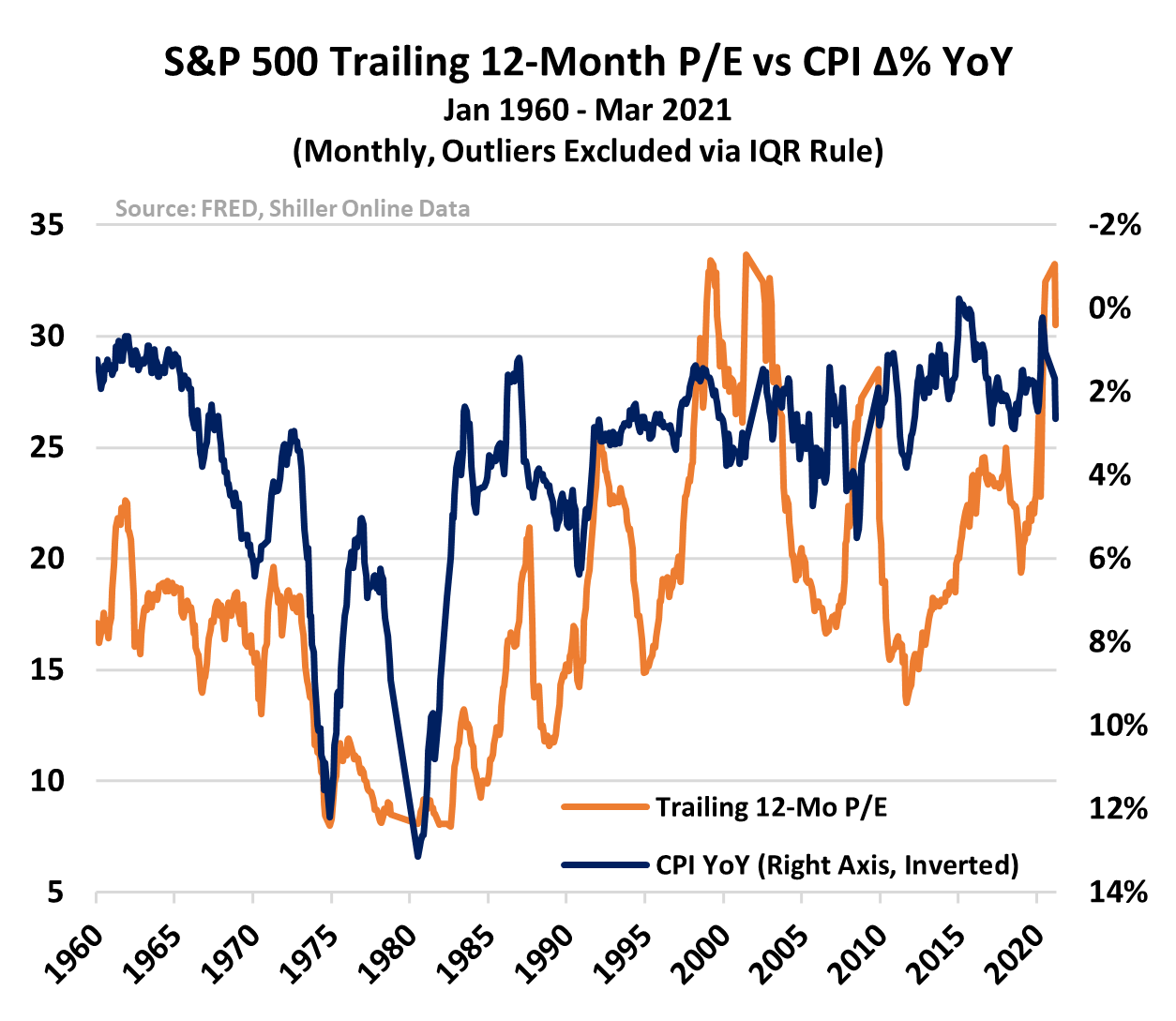

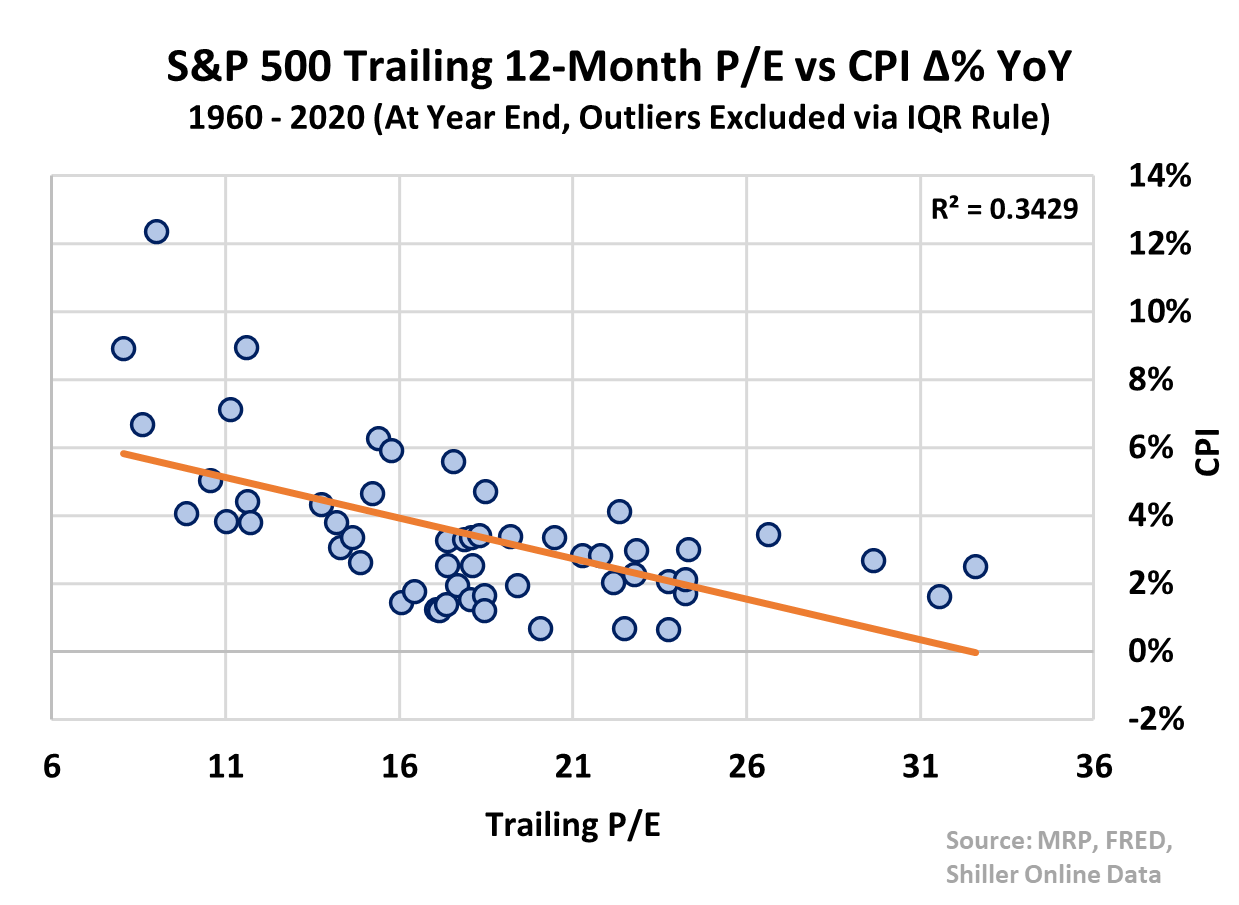

Elevated price to earnings ratios (P/Es) have usually been associated with abnormally low inflation and interest rates. By utilizing a time series of the S&P 500’s trailing 12-month P/E ratio, compared to YoY changes in the Consumer Price Index (CPI), it becomes immediately apparent that that these two variables are inversely correlated over the long term.

It wasn’t until recently that we have seen this relationship warped by breakout levels of inflation, spurred on by massive fiscal and monetary stimulus regimes.

Though virtually all inflation gauges are spiking to decade or multi-decade highs, we have ye t to see stock prices dragged down by rising rates – in turn, allowing multiples to run wild.

The majority of market participants continue to believe surging inflation over the past several months remains a transitory phenomenon. At MRP, we do not see it that way.

In fact, we fear that the next couple of years could bring on a huge downward revision to P/Es; one that will pull them back toward historically normal levels.

If inflation continues well above the Federal Reserve’s 2% target, interest rates should also rise back toward historic norms. That mean reversion will depress equity returns for years to come.

Most obvious is the effect of inflation on interest rates which, in turn, affects the discount rate applied to future streams of equity earnings. Higher inflation feeds through to higher rates, which then raise that discount rate, reducing the present value of those future earnings.

The majority of money managers agree that profits are bound to slow soon. According to Bank of America’s monthly fund manager survey, profit expectations among 257 respondents, managing $749 billion in assets, found just 41% expect profits to improve going forward – a significant decline from a March peak of 89%. For the first time since July 2020, the majority of respondents indicated they expect margins to decline.

Hotter inflation not only pushes up longer-term rates, but the likelihood of the Fed taking action to hike short-term interest rates as well. Though speculation around a tightening of monetary policy, primarily in the form of tapering back the central bank’s current pace of $120 billion in monthly asset purchases, has been rising, Fed Chairman Jerome Powell delivered mixed signals last week at Jackson Hole Economic Symposium. According to the transcript of his speech:

“At the FOMC’s recent July meeting, I was of the view, as were most participants, that if the economy evolved broadly as anticipated, it could be appropriate to start reducing the pace of asset purchases this year. The intervening month has brought more progress in the form of a strong employment report for July, but also the further spread of the Delta variant. We will be carefully assessing incoming data and the evolving risks… We have said that we will continue to hold the target range for the federal funds rate at its current level until the economy reaches conditions consistent with maximum employment, and inflation has reached 2% and is on track to moderately exceed 2% for some time.”

The fact that Fed officials had to ditch the traditional meeting in Wyoming at the last minute, opting instead for a virtual gathering, was symbolic of the uncertainty that rising COVID-19 cases have injected into the monetary policy outlook.

Stocks surged higher in the wake of those comments, reflecting investors’ view that Powell and company are now more hesitant to take a more aggressive approach toward tightening. If the Fed does ultimately back off on cutting asset purchases, or the Federal Open Market Committee (FOMC) pushes back projected rate hikes beyond 2023, breakout inflation is going to become harder to ignore or dispel as “transitory”.

Price Pressures Remain Palpable

As MRP noted back in our May Viewpoint, When Jay Blinks, any acknowledgment that the current inflation surge may last longer than initially expected could coincide with the suggestion that rates may have to go up sooner than anticipated, which would likely poke a hole in the continually buoyant equity market.

As we have previously noted, our view is that inflation is ultimately a monetary phenomenon. The various line items, such as supply chain disruptions, post-Covid re-openings, and rising home prices can make the consumer price index calculation can go up and down and drive changes in the monthly numbers, but a sustained rise in the overall number typically…

To read the complete Viewpoint, current MRP Pro and All-Access clients, SIGN IN MRP Pro clients receive access to MRP’s list of active themes, Joe Mac’s Market Viewpoint, and all items included as part of the MRP Basic membership. For a free trial of our services, or to save 50% on your first year by signing up now, CLICK HERE