Coinciding with the close of Q2 2021, this month’s Viewpoint offers a quick look at the state of the markets, followed by an overview of our active and recently suspended MRP themes.

The first half of 2021 was extraordinary for equities. The S&P 500 and Nasdaq have recently touched all-time highs and the Dow is not far off from its own record. Investor exuberance has persisted in the face of disturbingly high inflation readings and early indications that rate hikes may be coming sooner than expected – although the US Fed is still projecting any change to short term rates to be two years away.

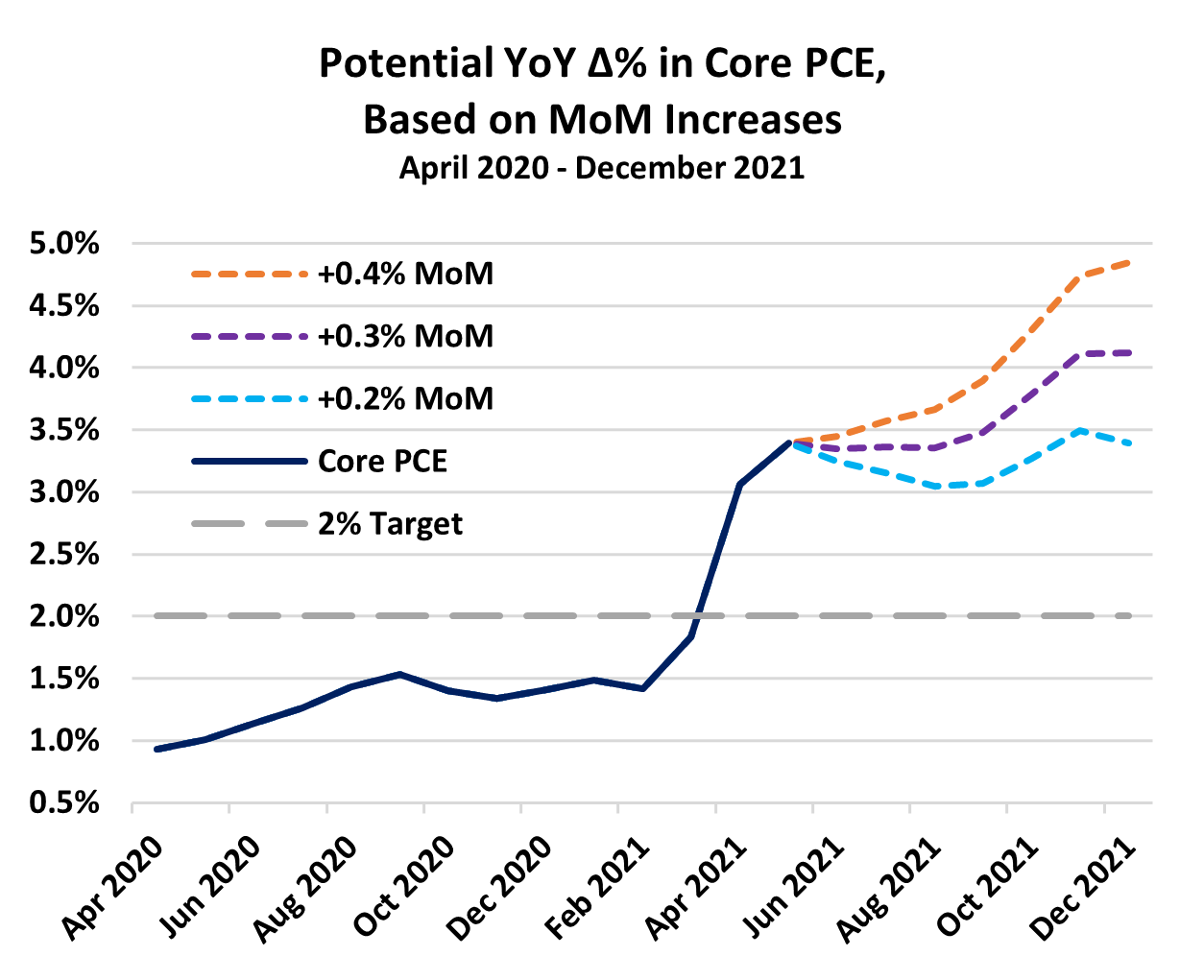

The FOMC’s updated expectations came amid a continuing surge in inflation, which has pushed the Core Personal Consumptions Expenditures (PCE) index to a 29-year high of 3.4%. That’s well above the Fed’s average inflation target of 2.0% and marks the second consecutive month the Fed’s preferred gauge of inflation pressed above the 3.0% threshold.

Even with MoM prints as low as 0.2% for the rest of the year, the core PCE would remain above 3.0% for the duration 2021. If we project 0.4% MoM gains (less than May’s 0.5% monthly gain) in the Core PCE over that period, we can expect a YoY reading as high as 4.9% in the index by the end of 2021.

Even with MoM prints as low as 0.2% for the rest of the year, the core PCE would remain above 3.0% for the duration 2021. If we project 0.4% MoM gains (less than May’s 0.5% monthly gain) in the Core PCE over that period, we can expect a YoY reading as high as 4.9% in the index by the end of 2021.

The remarkable bullish sentiment has been largely fueled by a steep drop in new cases of COVID-19 across the US, the resulting economic rebound, and assurances from Fed policymakers that surging inflation will be transitory. Most observers seem to have embraced the Fed’s view, but not all.

Last month we wrote that “MRP is more and more convinced that late this year the Fed chair will indeed blink and be unable to continue arguing that the inflation upsurge is transitory and will go away on its own”. Indeed, we retain our view that that the ongoing rise in price pressures will be sustained, causing the central bank to become more hawkish earlier than many expect.

In the short run, buoyancy in asset prices is likely to linger on, but alpha generation may be an increasingly challenging task if the Fed begins to prioritize tapering and longer-term rates resume the rise that characterized the first quarter of the year. Therefore, as the back half of 2021 gets underway, market participants will be well-served to focus on thematic ideas, and the identification of change-driven themes is our mission at MRP.

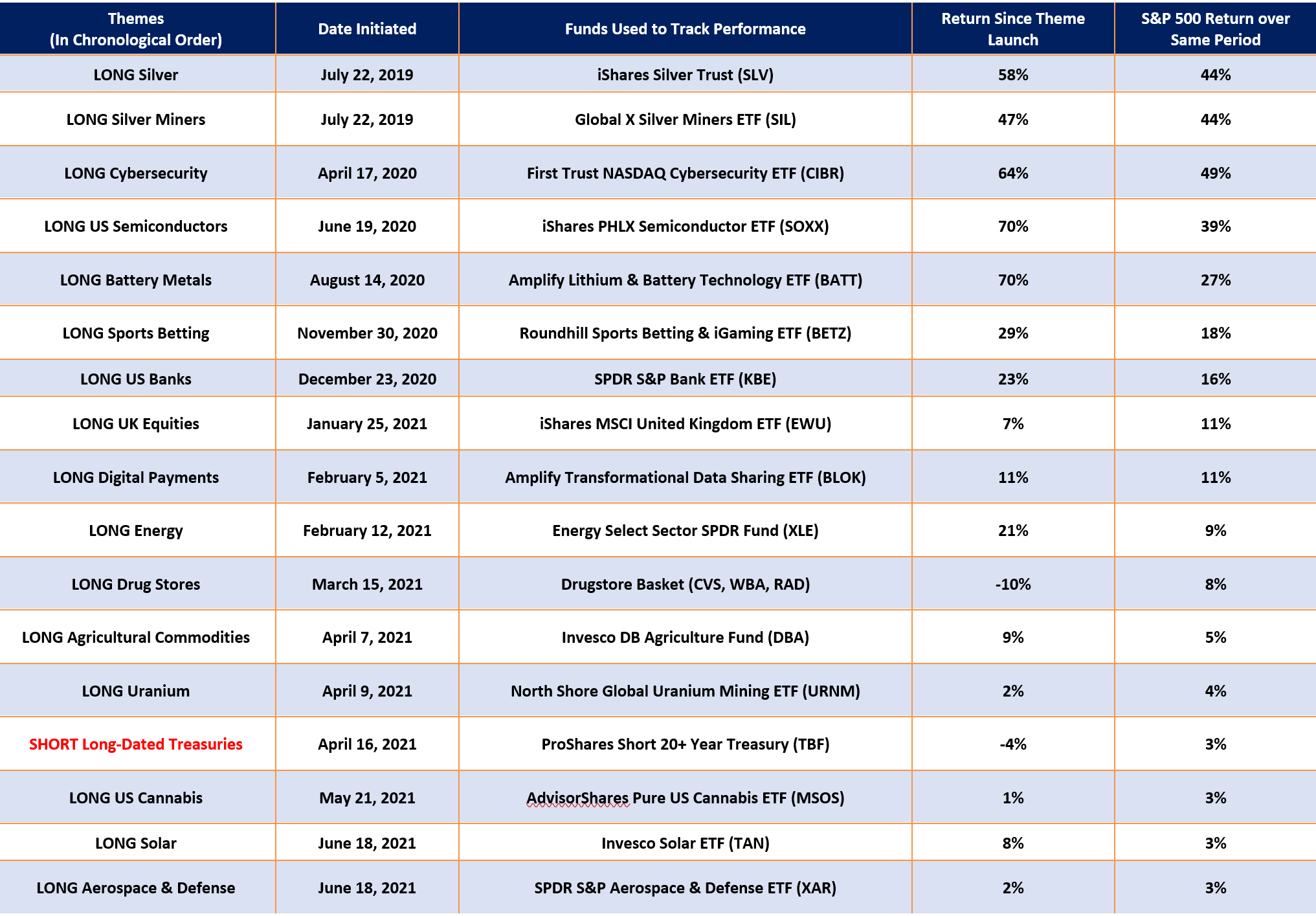

Thus, in the face of all the uncertainty in the markets, a review of our Active List of Themes is in order. Currently, we have a total of 17 active themes. Since our last update in December 2020, we’ve suspended 13 themes.

What follows below:

-

A tabular, mid-year review of MRP’s current list of open themes, displaying returns of the underlying funds we utilize to track their performance

-

Detailed breakdowns of each individual theme

-

An overhead view of the themes we closed throughout the past year

-

LONG Silver & Silver Miners

MRP added Long Silver & Silver Miners to our list of themes on July 22, 2019 based on the rationale that looser central bank policy would push bond yields lower and benefit zero-yielding assets such as gold and silver whose relative attractiveness would then rise. Bond yields remain historically low, and breakout inflation as a result of COVID-related spending has supported our hypothesis.

At the same time, cheap money from the Federal Reserve’s seemingly limitless QE program continues to debase the value of the Dollar. The Fed’s balance sheet has expanded by more than $4.2 trillion, or 115%, since August of 2019, when the Fed halted their most recent bout of balance sheet tightening. The value of the greenback and precious metals often run inverse to one another, and the US Dollar Index (DXY) has declined by more than 11% since its peak in March 2020.

Additionally, the rise of green energy – particularly solar energy – should propel silver prices even higher. As MRP noted earlier this year, BMO Capital Markets says governments across the world have approved more than $50 billion of environmentally friendly stimulus measures this year. The Silver Institute released a report, produced on its behalf by CRU Consulting, estimating that demand for silver in PV cells, used for solar power, will be a cumulative 888 million ounces between this year and 2030. BMO is even more bullish on silver’s utility to the solar industry, projecting around 1.5 billion ounces of PV demand from 2020 through 2030.

In a separate report, the Silver Institute projected global demand for silver will rise to 1.025 billion ounces in 2021, its highest in eight years.

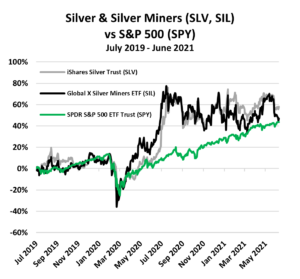

Since we added LONG Silver & Silver Miners to our list of themes, the iShares Silver Trust (SLV) and Global X Silver Miners ETF (SIL) have returned +58% and +47%, respectively, each outperforming the S&P 500’s +44% over the same period.

-

LONG Cybersecurity

MRP added Long Cybersecurity to our list of themes on April 17, 2020 due to an uptick in COIVD-themed cyberattacks. Additionally, businesses are betting on remote work arrangements enduring even after the current restrictions end. This should translate to more spending on cybersecurity moving forward, with the cloud- and software-based security segments winning an ever-greater piece of that spending.

Even as many return to their in-office assignments, remote work is proving more to suitable for certain businesses and employees over the long term. According to a recent Microsoft survey, 73% of respondents said they would prefer flexible remote option to continue. Forbes took it one step further and reported that 58% of workers surveyed would look for a new job if remote offerings are not extended.

Cybersecurity was recently foisted to the forefront of news headlines last month when Colonial Pipeline announced that its IT systems were “the victim of a cybersecurity attack” last weekend, forcing the shutdown of 5,500 miles of pipeline that carry nearly half of all fuel supplies on the East Coast. That attack came in the wake of a previous breach of US federal government servers, via IT firm SolarWinds. As MRP previously noted, state-backed hackers (likely of Russian origin) were able to insert malicious code into an update of Orion, one of SolarWinds’ platforms. It initially became clear that the Departments of Commerce, the Treasury, and State – which used SolarWinds’ IT infrastructure – were breached at some level, but that was only the beginning. In all, nine federal agencies and 100 private companies have been confirmed compromised thus far.

MRP believes this is a breakout moment for the cybersecurity industry. Going forward, more activity – be it work, school, health or civic – will be conducted online than before the coronavirus pandemic. The networks and tools enabling such activities will require even sturdier security features. That should result in more money being invested into cybersecurity.

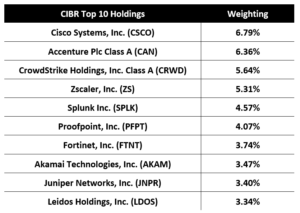

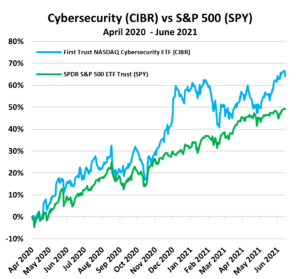

Since we launched the theme, the First Trust NASDAQ Cybersecurity ETF (CIBR) has returned +64%. Over the same period the S&P 500% has risen +49%.

To read the complete Viewpoint, current MRP Pro and All-Access clients, SIGN IN MRP Pro clients receive access to MRP’s list of active themes, Joe Mac’s Market Viewpoint, and all items included as part of the MRP Basic membership. For a free trial of our services, or to save 50% on your first year by signing up now, CLICK HERE