Widespread protests have broken out across China in opposition of yet another bout of lockdowns in the world’s second-largest economy. On and off isolation policies have frustrated the Chinese citizenry throughout the past year amid a backdrop of turmoil in the country’s banking and real estate industries. Tensions now appear to have peaked and boiled over into the streets, threatening even more damage to the increasingly fragile Chinese economy.

Up to a quarter of China’s GDP may be negatively affected by COVID controls. If the protests were to achieve concessions from the Chinese government and ease lockdown measures, it would arguably be a positive sign for the country’s equities and economy. However, that appears unlikely with Chairman Xi Jinping’s recent bid to strengthen his grip over the mainland.

Related ETF: iShares MSCI China ETF (MCHI)

Videos of protests and other demonstrations against ongoing COVID-induced lockdowns in China are circulating widely on social media. Based on a growing body of reporting, these actions appear to be intensifying in scope and aggression and are often accompanied by photos or videos depicting the drastic measures Chinese authorities have taken to enforce their lockdown protocols.

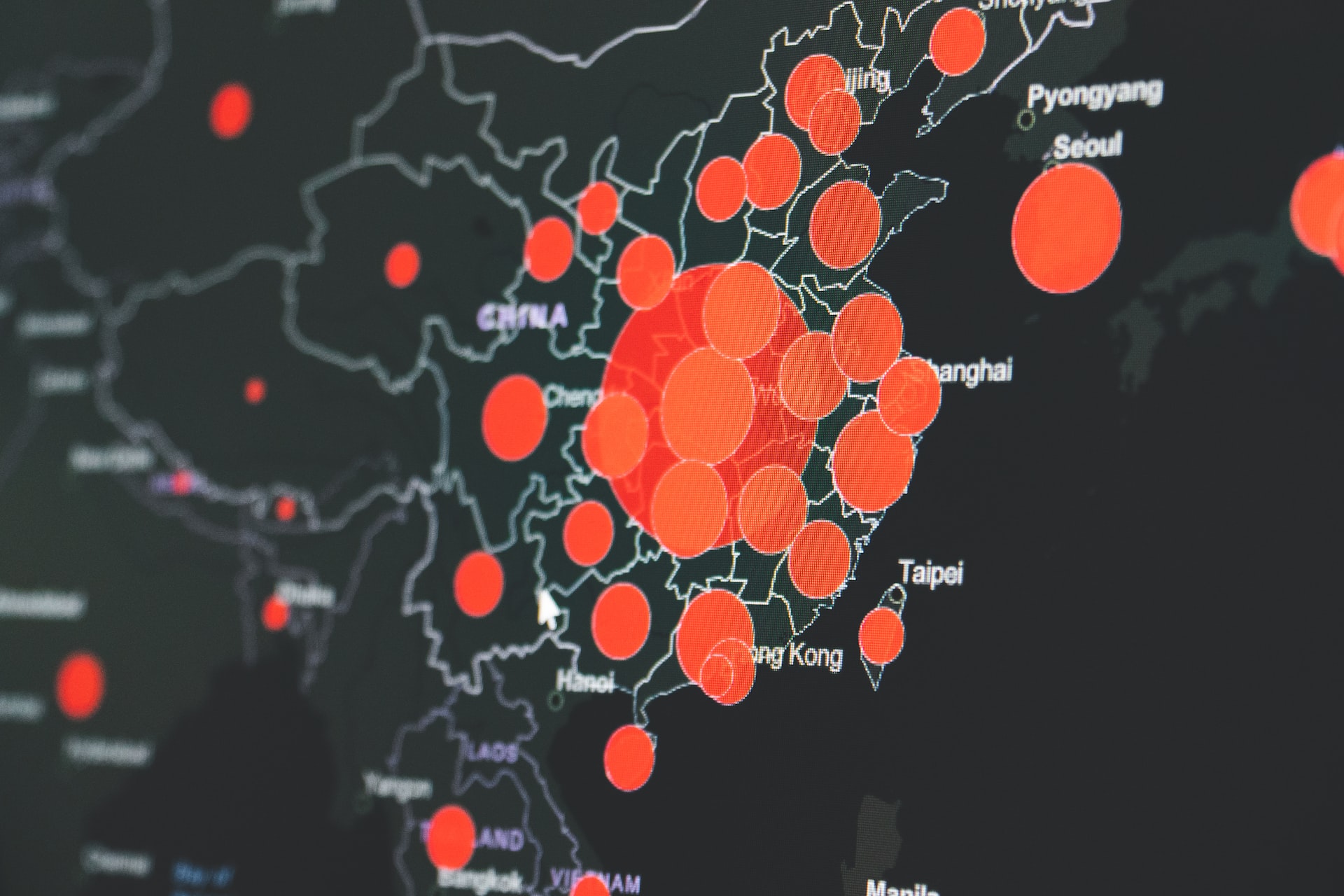

Hundreds of millions of people are essentially expected to remain confined to their homes indefinitely, while key manufacturing and transport hubs are being shut. As of Monday, 25.1% of China’s GDP was negatively affected by COVID controls, according to a Nomura model cited by CNBC. That’s above the prior peak of 21.2% recorded in April during the lockdown in Shanghai. Protests have been reported in major cities including Shanghai, Wuhan, Guangzhou, and Tianjin.

MRP has repeatedly highlighted the significant damage Zero COVID policies have wreaked on the economy and demographics of Hong Kong. Though Worldometer data shows active cases in the mainland have reached two-year highs recently, comparable only to the original outbreak of the COVID-19 virus in early 2020, large swathes of the Chinese citizenry have become visibly outraged by sporadic returns to strict anti-COVID policies. Long periods of isolation, combined with vaccine hesitancy and other cultural phenomena, could be exacerbating the virus’s resilience.

Perhaps the lockdowns alone would not usually be enough to send China spiraling into a wave of mass civil disobedience, but the compounding of this crisis by the economic turmoil that many Chinese families are facing may ultimately be what has led us here. Protests throughout the Chinese mainland have not been particularly common for some time. However, as MRP has repeatedly noted, they have occurred more often throughout 2022, as a gust of defiance has been thick in the air.

If we go back to late 2021 and into the start of this year, protests involving hundreds of investors in financial products issued by China Evergrande Group kicked off and made headlines. Evergrande, one of country’s top real estate developers and among the earliest victims of China’s ongoing property crisis, experienced several protests outside its offices in Guangzhou, amid its ultimate descent into default, by creditors who were denied interest payments and other benefits derived from the company’s popular wealth management products.

The in-person protests died down, but the cascading property sector meltdown that has ensued throughout the past year and a half would ultimately result in an ongoing mortgage boycott across dozens of Chinese cities, which MRP first highlighted in July. Back then, Citigroup analysts claimed…

To read the complete Intelligence Briefing, current All-Access clients, SIGN IN All-Access clients receive the full-spectrum of MRP’s research, including daily investment insights and unlimited use of our online research archive. For a free trial of MRP’s All-Access membership, or to save 50% on your first year by signing up now, CLICK HERE